Assessing Ray Dalio's Latest Warnings on Geopolitical Tensions

Ray Dalio's latest warnings connect domestic polarization to rising war risks between major powers—but his stark predictions may overstate how close we are to systemic collapse.

15 posts with this tag

Ray Dalio's latest warnings connect domestic polarization to rising war risks between major powers—but his stark predictions may overstate how close we are to systemic collapse.

Ray Dalio reveals how the Fed's unusual economic maneuver transferred wealth from government to households, creating today's resilient economy—but warns of a looming debt spiral ahead.

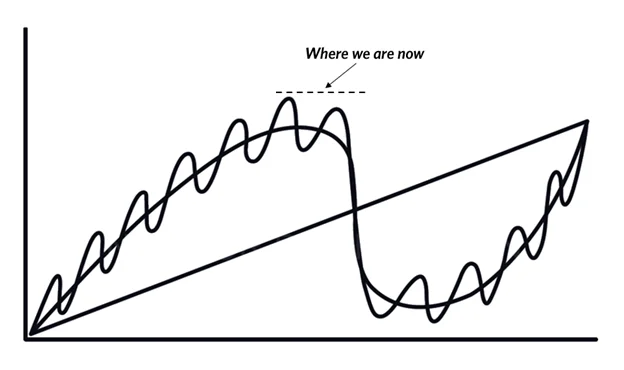

Dalio warns we're heading into a debt crisis within 1-2 years as the Fed must print money to meet bond demand, while the US sits at a cyclical low point needing change.

Ray Dalio warns we're halfway through the 13th debt cycle with unsustainably high debt levels, near the breaking point where major restructurings and conflicts loom.

Ray Dalio estimates a 35-40% chance of disruptive civil and international wars in the next decade, alongside a 60% probability of major debt restructuring in reserve currencies.

Ray Dalio's latest dialogue reveals surprising GDP predictions for China and a rare optimistic note on US-China relations—if we can avoid military conflict.

Ray Dalio and Kevin Rudd agree on China's shift toward state control, but I found one crucial insight that reveals why foreign investors shouldn't panic yet.

Ray Dalio warns we're approaching the war stage of his Big Cycle framework, with highest risk in 2025-26—but how worried should we really be about his prediction?

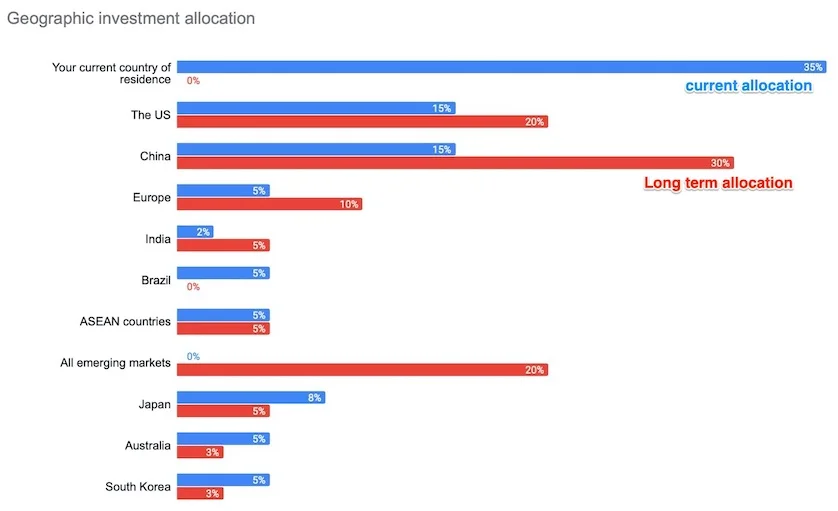

I'll show you how to adapt Ray Dalio's hedge fund wisdom to protect your wealth during inflation, rising rates, and market turmoil—turning macro chaos into actionable steps.

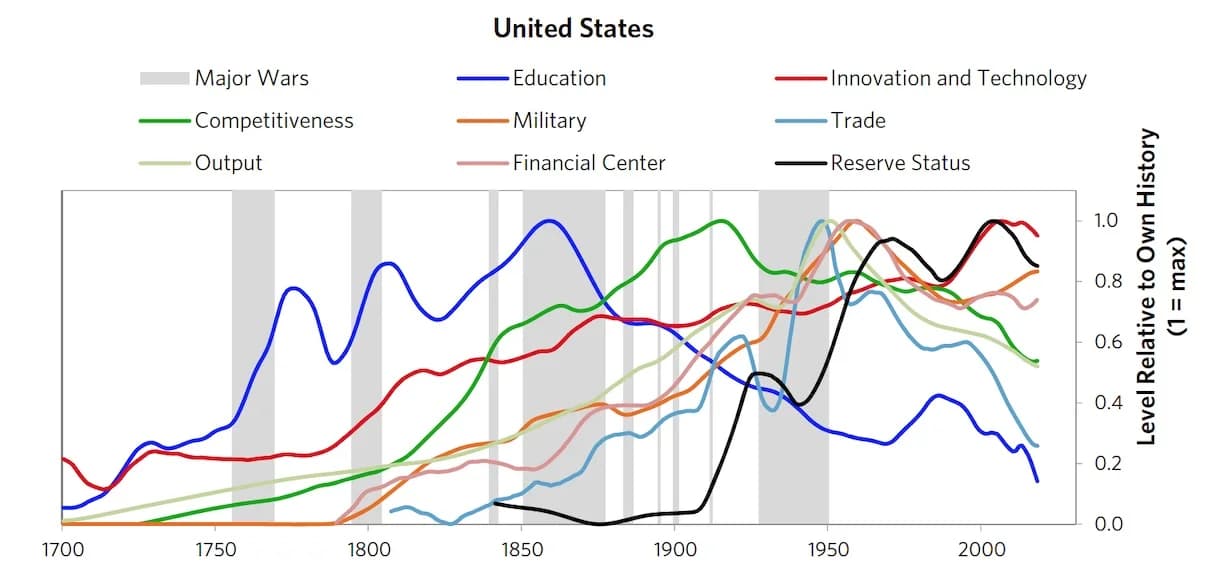

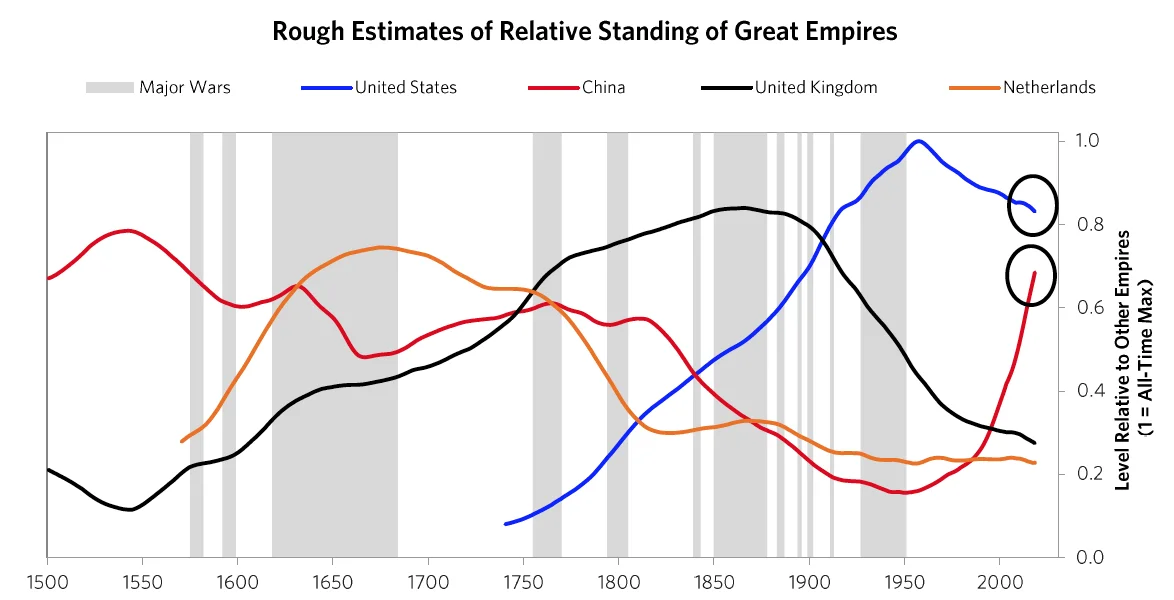

Dalio maps the U.S. at 70% through its empire cycle—in decline—while China rises, backed by data-rich analysis that reveals far more nuance than headlines suggest.

Ray Dalio's latest chapter reveals unsettling parallels between today and the 1930s-1945 period—from wealth gaps to economic warfare—suggesting the US peaked in the 1950s.

I've learned to apply Ray Dalio's big cycle insights to my personal finance by prioritizing debt reduction and defensive positioning—here's how you can prepare for the volatility ahead.

Ray Dalio's 500-year analysis of empire cycles reveals why today's confluence of debt, inequality, and US-China tensions creates unprecedented danger.

Ray Dalio's historical analysis reveals today's "unprecedented" events are actually predictable patterns—empires rise and fall in cycles, and understanding these helps us prepare for the shifting US-China power dynamic ahead.

I discovered Ray Dalio's principles on radical transparency and debt cycles, transforming how I think about decision-making and building resilient portfolios.