Ray Dalio just published another LinkedIn article today about “What’s Happening with the Economy? The Great Wealth Transfer.” It’s a valuable read for anyone interested in understanding the complexities of the global economy and the intricate interplay of various economic forces.

The Great Wealth Transfer: A Snapshot

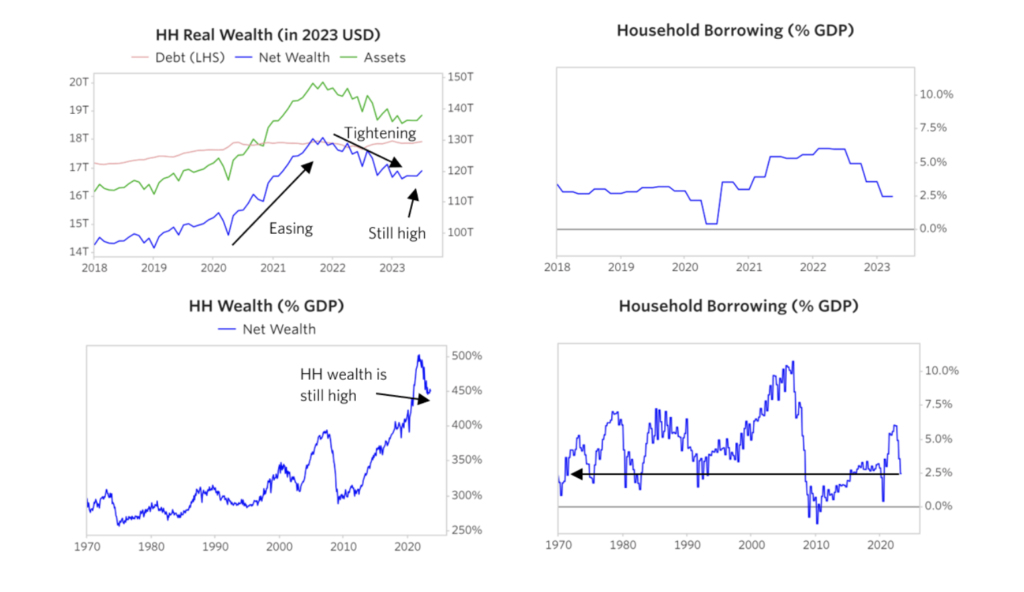

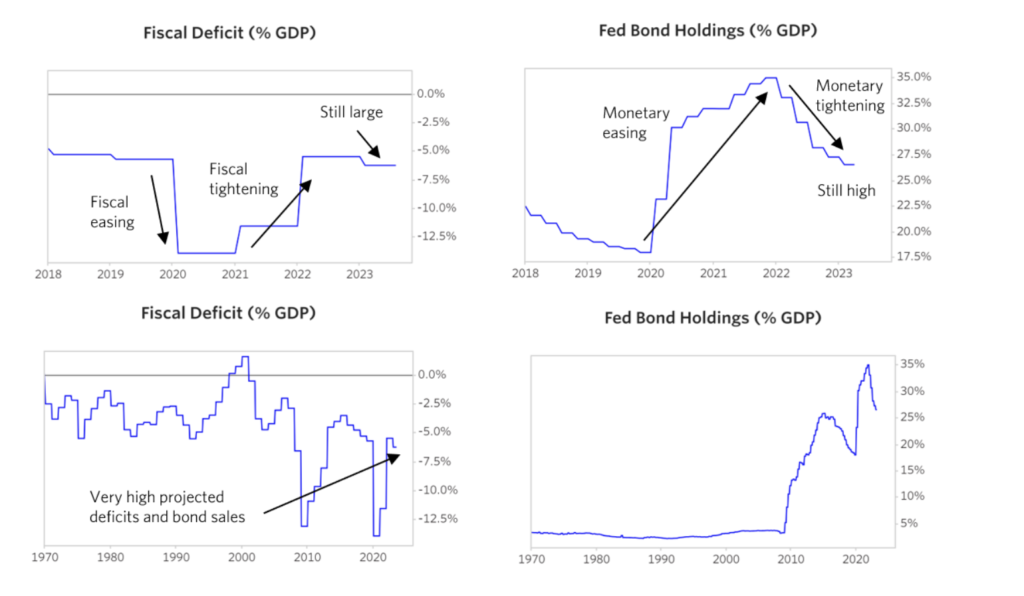

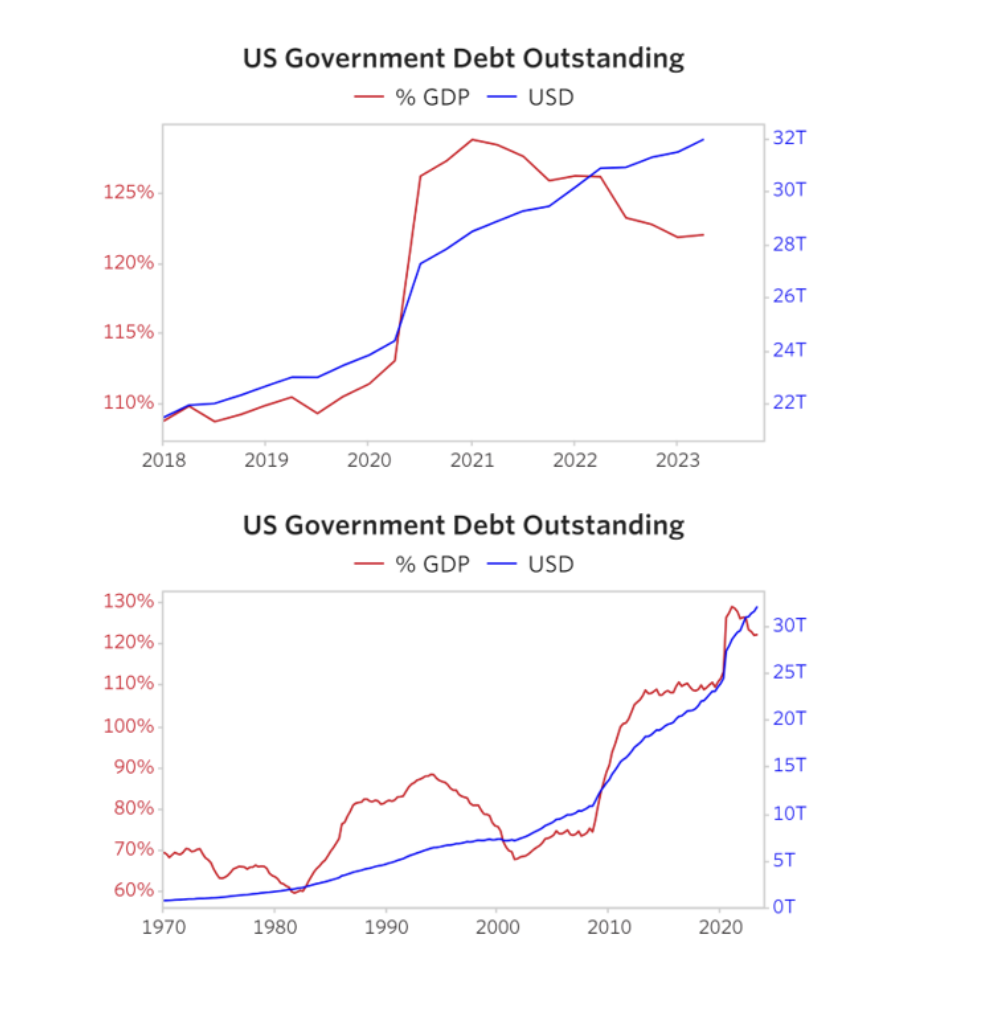

Ray Dalio explores the unusual reaction of the economy to the Federal Reserve’s tightening, highlighting that it’s stronger than expected. He attributes this to a government-engineered shift in wealth from the public sector and bondholders to the private sector, making the private sector relatively insensitive to rapid tightening. This maneuver led to good financial shape in the household sector, while the government’s financials deteriorated.

The below graphs (from his article) demonstrate the above

The above indicates the overall picture across all households in the US but of course, we know different economic classes are very different.

Dalio explains that central governments took on more debt, and central banks printed more money, leading to inflation. This occurred during 2020 and 2021, with huge budget deficits and central bank purchases of bonds. The private sector’s net worth rose, unemployment rates fell, and compensation increased, while central governments got more in debt.

He warns that the bad balance sheets of central governments and banks do matter, and the situation may become a big problem later. Dalio refers to his book “Principles for Navigating Big Debt Crises” to explain the typical maneuver used at this stage in the long-term debt cycle.

Looking ahead, Dalio predicts a period of tolerably slow growth and tolerably high inflation (mild stagflation) in the near term. However, he foresees large and growing central government deficits leading to a self-reinforcing debt spiral, with central banks forced to print more money.

Dalio also presents various charts to illustrate the forces he described, showing measures like total income, employment income, total spending, savings rate, real household wealth, unemployment rate, budget deficit, interest rates, inflation, and more.

He concludes by pointing out the disparities in different countries, sectors, and businesses, and the big structural changes that are altering everything. He also mentions the five big forces: financial economic force, domestic conflict force, international conflict force, acts of nature force, and the force of technologies.

Thought-Provoking Questions and Insights

- The Great Wealth Transfer: How will the shift of wealth from the public sector to the private sector impact long-term economic stability? Is this a sustainable approach, or does it merely delay a more significant crisis?

- Central Government Debt: With central governments’ deficits predicted to grow, leading to a self-reinforcing debt spiral, what measures can be taken to mitigate this risk? How can governments and central banks navigate this complex situation without causing further economic disruption?

- Structural Changes and Big Forces: Dalio highlights several big structural changes and forces that are shaping the global economy. How will these forces interact and influence each other in the coming years? What strategies can governments, businesses, and individuals adopt to adapt to these unprecedented changes?

The article is rich in data and insights, providing a comprehensive view of the current economic landscape and potential future scenarios.

Cheers,

Chandler

(The above summary is done with the help of AI)

[jetpack_subscription_form]