Ray Dalio has recently published two more articles on LinkedIn that double down on the cautious, even alarmed view he has espoused about rising global

Read more

A personal blog about expatriates in the US, AI, Leadership, Geopolitics.

Ray Dalio has recently published two more articles on LinkedIn that double down on the cautious, even alarmed view he has espoused about rising global

Read more

Ray Dalio just published another LinkedIn article today about “What’s Happening with the Economy? The Great Wealth Transfer.” It’s a valuable read for anyone interested

Read more

In June 2023, Ray Dalio, the founder of Bridgewater Associates, participated in two insightful conversations that shed light on the changing world order. As someone

Read more

Ray Dalio, the founder of Bridgewater Associates and author of “Principles for Dealing with the Changing World Order,” recently published a LinkedIn post titled “Where

Read more

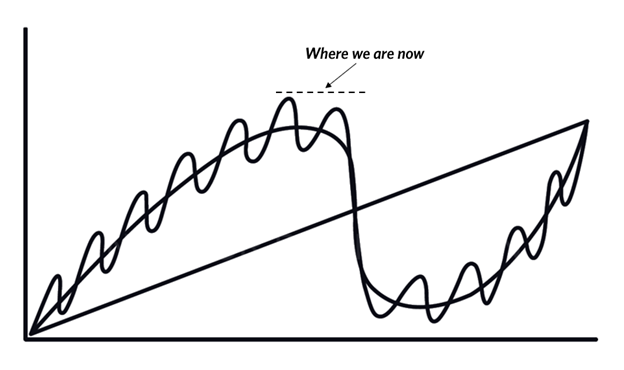

Ray Dalio just posted part 2 of the Two-Part Look at 1. Principles for Navigating Big Debt Crises, and 2. How These Principles Apply to

Read more