Ray Dalio, the founder of Bridgewater Associates and author of “Principles for Dealing with the Changing World Order,” recently published a LinkedIn post titled “Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder.” In this post, he outlines the historical patterns and forces shaping the world and predicts a period of significant disruptions and challenges ahead. In this blog post, we’ll summarize the key points of Dalio’s analysis and offer a perspective on the potential implications of his insights.

1. Summary of Ray Dalio’s Article

Ray identifies five forces driving global changes:

1) the credit/debt/market/economic cycle,

2) the internal peace/conflict cycle shaping domestic order,

3) the external peace/conflict cycle shaping international order,

4) acts of nature, and

5) human inventiveness and technology.

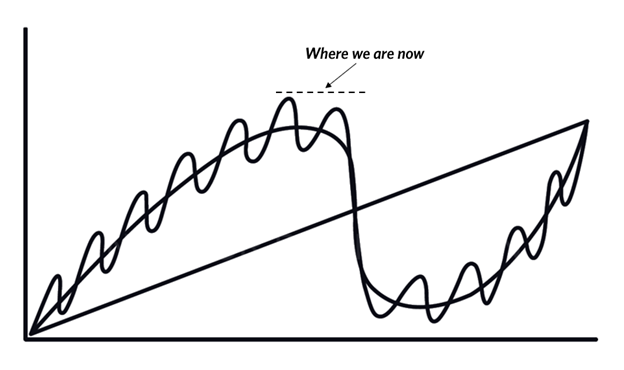

Drawing from historical patterns, Dalio argues that these forces are now at their highest magnitude since the 1930s, potentially leading to significant shifts in the financial, domestic, and global orders. This, of course, can also mean terrible conflicts between great powers.

Where We Are in the Big Cycle and Where We’re Headed

“Since 1945 there have been 12 and a half credit/debt/market/economic cycles and associated political cyclical swings. We are now about halfway through the 13th short-term debt cycle. This is when the tightening to fight inflation is causing a cracking in the financial markets and just before there is the economic contraction part of the cycle.” – Ray wrote.

“Looking at the long-term debt cycle, debt asset and debt liability levels have become unsustainably high via unsound finances, and debts are projected to increase so much that they will have to be bought by central banks (who themselves are close to having negative net worths because of the big losses they have on the debts they already bought). Given these conditions, it appears that interest rates that are high enough (and money and credit that is tight enough) to fight inflation and provide lender-creditors with adequate real returns will be unbearably high for borrower-debtors. This means the system is close to the point where big restructurings will be needed.”

In his analysis, Dalio places significant emphasis on the roles of the United States and China, particularly in the context of great power conflict. He also touches upon the potential effects of climate change, technology, and internal political conflicts within countries, highlighting the need for collaboration and a focus on the greater good.

2. Perspective on Dalio’s Analysis

Ray’s latest article is consistent with his previous writings. (A summary of his previous writings is here).

With this post, he is a lot more specific/direct about timing and where we are in both the short-term and long-term debt cycles. The 2024 elections in the US and Taiwan are not that far away. And given the domestic dynamics in both countries (US and China), from Ray’s perspective, we should expect the relationship to deteriorate further. I am not sure how much lower the relationship can go before a direct/indirect kinetic conflict happens. 🙁

Hopefully, now that Kevin Rudd is the AU ambassador to the US and he continues to be a strong advocate for managed strategic competition, the chance of a “hot” war is reduced.

Technology, as one of the five driving forces, has the potential to bring about both positive and negative consequences. It’s crucial to consider ethical, social, and environmental implications when examining the role of technology in shaping the future.

Finally, Dalio’s emphasis on collaboration and working together for the greater good is an important message that encourages us to look beyond individual interests. However, history has shown that self-interest often outweighs collective interests. We should remain cautiously optimistic, but also be prepared for potential challenges and disruptions.

3. Conclusion

Ray Dalio’s article provides a compelling analysis of the historical patterns and forces shaping our world, predicting a period of significant disruptions and challenges. While his insights offer valuable perspectives, it’s essential to consider multiple sources and viewpoints to form a well-rounded understanding of the topic. As we navigate the potential uncertainties of the future, a focus on collaboration and addressing ethical, social, and environmental concerns will be crucial in creating a better world for everyone.