Credit card rewards programs can be both a blessing and a curse, depending on how they are managed. While some consumers can reap significant benefits

Read more

A personal blog about expatriates in the US, AI, Leadership, Geopolitics.

Credit card rewards programs can be both a blessing and a curse, depending on how they are managed. While some consumers can reap significant benefits

Read more

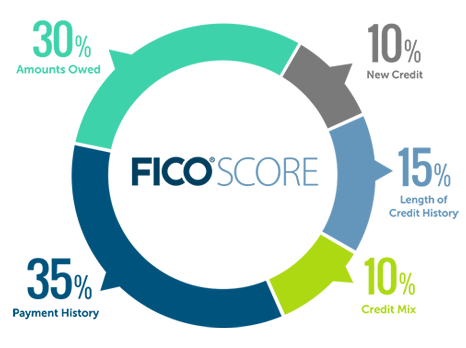

A credit score is a numerical representation of your creditworthiness. It is used by lenders to determine your risk as a borrower and is calculated

Read more

If you are unfamiliar with the FICO score, it is the most widely used credit score in the US, with more than 90% of top

Read more

After I wrote a few articles about building credit scores for expats in the US, a few people reached out to me to share that

Read more

When it comes to credit reports, most people don’t give them a second thought – until something goes wrong. If you’re an expat in the

Read more