If you are unfamiliar with the FICO score, it is the most widely used credit score in the US, with more than 90% of top lenders using it to make lending decisions. Fair Isaac Corporation (FICO) created the FICO score about 30 years ago, and you can read all about it from the official website. This post is a high-level summary of everything that I think is more important to know about, especially from an expat perspective.

What is Fico score?

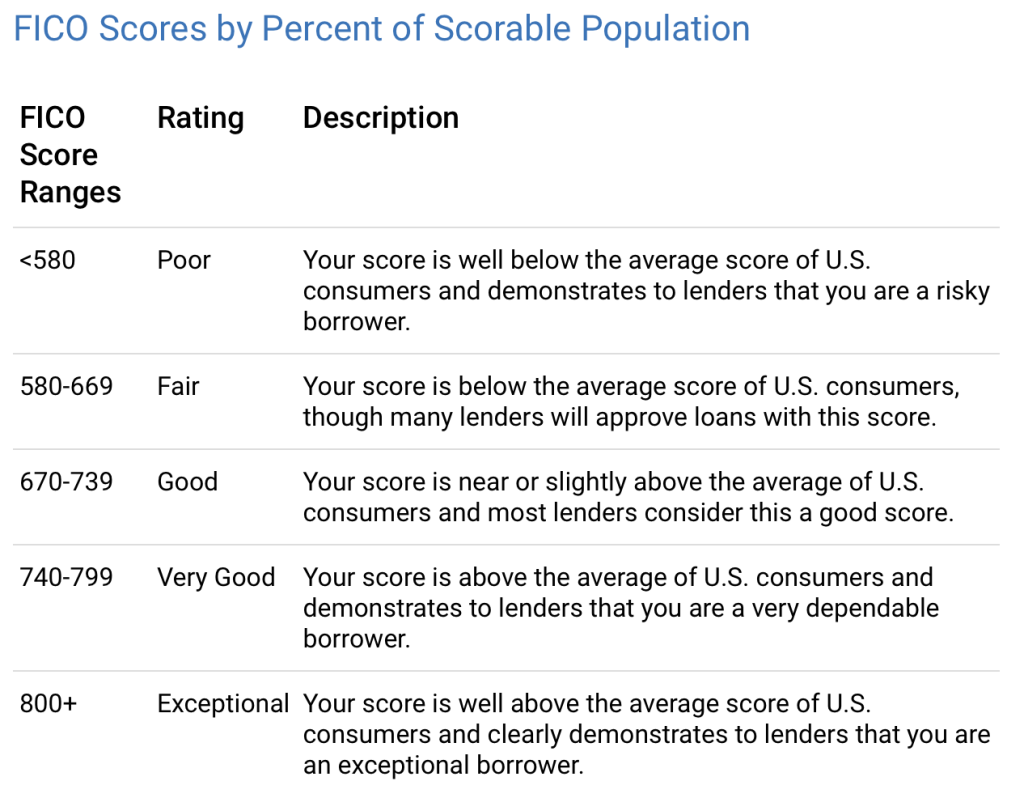

FICO Scores are a three-digit number based on the information in your credit reports. It helps lenders make smarter, quicker decisions about who they loan money to. However, they have different criteria forwhat is considered a good FICO Score. Below is the rough guide

A good FICO Score can save you thousands of dollars in interest and fees. While Fico score is the most widely used, it is not the only credit score in the US. Other credit scores calculate scores differently than FICO Scores.

There are different FICO score versions

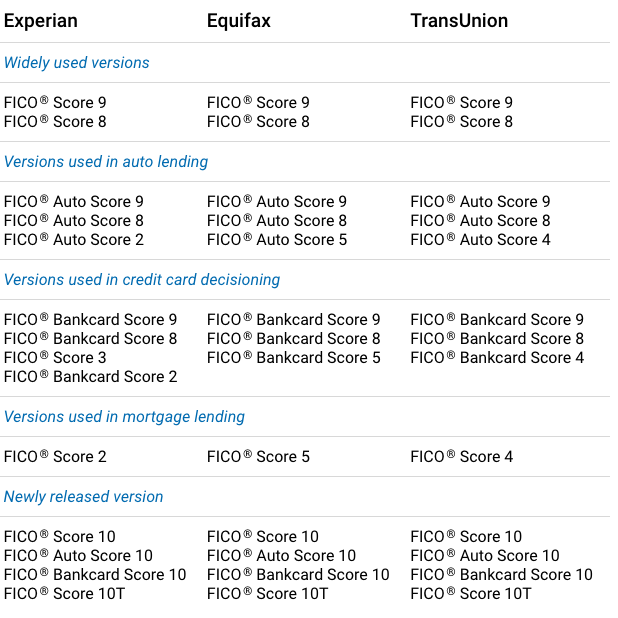

“As consumer demand for credit, consumer use of credit, lender credit-granting requirements, and data reporting practices evolve over time, we periodically redevelop the FICO Score model to provide a more predictive score to lenders and consumers.” (direct quote from FICO website). There are multiple versions of FICO Scores available, including industry-specific versions. FICO Score 8 and 9 are the most widely used versions. FICO Score 10 is the latest version.

Some lenders may take longer to upgrade to the latest version of FICO Score. The details are below:

How FICO score is calculated?

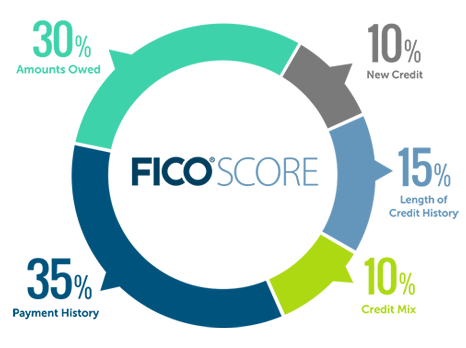

The picture below provides a good overview

Largely, there are five categories that are used to calculate FICO scores. Payment history is the most important factor in determining FICO Scores (35% contribution). FICO Scores are calculated only from the information in your credit report. However, lenders may look at other factors when making a credit decision.

“Payment history” – what to know

“Payment history shows how you’ve paid your accounts over the length of your credit. This evidence of repayment is the primary reason why payment history makes up 35% of your score and is a major factor in its calculation. Research shows that your track record of payment tends to be the strongest predictor of the likelihood that you’ll pay all debts as agreed to. And as you can imagine, a lender’s number one priority is your past record of paying back (or not) your loans.” (direct quote from FICO website)

Payment history includes credit cards, retail accounts, installment loans, mortgages, and other types of accounts. A few late payments are not an automatic “score-killer”. “An overall good credit history can outweigh one or two instances of late credit card payments”

Also, having no late payments does not guarantee a perfect score.

Bankruptcies, lawsuits, and wage attachments are considered quite serious. Bankruptcy can stay on a credit report for 7-10 years.

“Amount of debt” – what to know

Amounts Owed is a factor that makes up 30% of a FICO® Score. The amount owed on different types of accounts and the number of accounts with balances are also taken into account. Credit utilization ratio is an important factor in FICO Scores. So try to keep your utilization rate as low as possible. If your total revolving credit limit (aka available credit limit) is $10,000 across all your credit cards, and you have an outstanding balance of $3,000, the utilization rate is 30%.

In addition, having debt does not automatically make a person a high-risk borrower.

Paying off credit cards in full each month does not necessarily mean that the account balance will show as $0 on the credit report. One trick is to know which day of the month your monthly credit card statement is released (aka statement closing date) and preemptively pay as much as you can BEFORE that date to lower the statement balance.

“Length of credit history” – what to know

Length of credit history accounts for 15% of a FICO Score. The good news is that even people without a long credit history can have a high FICO Score if the rest of their credit report looks good.

It can be difficult to open lines of credit to build a FICO Score if you don’t have a good FICO Score.

However, establishing credit history can be done through secured credit cards, co-applicants, and keeping balances low and paying on time.

Don’t close your oldest account because closing it means you lower your length of credit history. And that may have a negative impact.

“Credit mix” – what to know

Credit mix is the types of credit you have, such as credit cards, retail accounts, installment loans, finance company and mortgage loans. “Creditors assess the risk of lending money through a variety of factors, one of them being your ability to successfully manage different types of credit.” Credit mix is only 10% of a FICO Score, so it won’t determine whether or not you obtain credit from lenders. A good credit mix can help your credit score, but it may not be worth the risk of a drop in your score to apply for a small loan.

Applying for multiple new credit lines within a short period of time can lower your credit score. Because, creditors may see an inordinate amount of new accounts within a small time frame as an indication of financial distress.

“New credit” – what to know

New credit makes up 10% of a FICO® Score. Opening several new credit accounts in a short period of time can represent greater risk. Every time there is a hard inquiry to your report, your score will be lowered by a few points temporarily. “Many types of inquiries are ignored completely. And the score allows for “rate shopping“

Checking your own credit report won’t affect your FICO Scores.

New credit card with large credit limit can help to reduce your credit utilization rate and hence improve your credit score over time.

There you have it, everything an expat should know about FICO score in the US. After this article, if you want to learn more about how to apply for a credit card without impacting your credit score, you can check out the link.

If you have any comments, feel free to let me know below. Or you can join a group on Facebook called Asian Expats in the US so that we can share/discuss more tips directly.

Chandler

[jetpack_subscription_form]