Many of you continue to visit this post, which I wrote back in Apr 2020 about the “Changing world order” by Ray Dalio. Since then, Ray has continued articulating his thinking and sharing additional insights with us. I have continued to follow his work and written many follow-up articles. I kept the original content below but will include more up-to-date content at the bottom of this post. I hope you find the newly updated content useful.

Alternatively, if the content is too long and you want to ask some questions, you can use the chatbot that I recently built here. (This is still an experiment so be aware of hallucinations).

Table of Contents

- The original content was written back in Apr 2020.

- “Unprecedented”?

- Was the US at its “empire peak” back in 1950 – 1960?

- What are the key factors contributing to an empire’s rise or fall in wealth and power?

- Share this with a friend

- Ray Dalio’s recent sharing/thoughts about the changing world order

- Sep 2024 : Ray Dalio’s 2024 Great Powers Index

- Oct 20, 2023: Assessing Ray Dalio’s Latest Warnings on Geopolitical Tensions

- Jun 19, 2023: Summary of Ray Dalio’s Jun 2023 conversations with Thomas Friedman and Bloomberg Invest

- Apr 26, 2023: “The United States and China are on the brink of war and are beyond the ability to talk.”

- Apr 19, 2023 update: Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder

- Relative empire standings across major countries Jan 2023

- Mar 2023 update

- Feb 2023 update

- Jan 2023

- Nov 2022

- The relative standing of great empires Apr 2022

- 20 Mar 2022 update

- Jul 2020

- How to apply Ray Dalio sharing to your personal finance?

The original content was written back in Apr 2020.

It shouldn’t be a surprise to learn that Ray Dalio continues to share with the world his wisdom about lessons learned from history, where we are and what to come.

He recently did an interview with TED titled “what coronavirus means for the global economy” and also started to share a great series on LinkedIn “The changing world order“. Reading the first chapter “The big picture in a tiny nutshell” will give you a lot of context behind Ray’s comments on TED. So I encourage you to read the article first before watching the TED talk.

We are at the end of one era and the beginning of another. The old world order that emerged after WWII is coming to an end. America has been the dominant world power since then, but its relative position is declining as other countries rise. The global economy is becoming more multipolar with the rise of China, India, and other countries.

Since I wrote this post, Ray released a few more articles in the series. He did a few interviews on Bloomberg, Goldman Sachs, Bridgewater Associates‘ channel. So I decided to update this post with my thinking on his latest articles.

“Unprecedented”?

If you follow the news, especially over the past 3-5 years, the word “unprecedented” is used in many situations. Every day, there seems to be something new. Every other month, a leader somewhere does something unprecedented. Too much noise can distract us from the larger themes and that is one key thing Ray reminds us, by helping to distill key insights over the past 1500 years about how different empires/countries rose and fell.

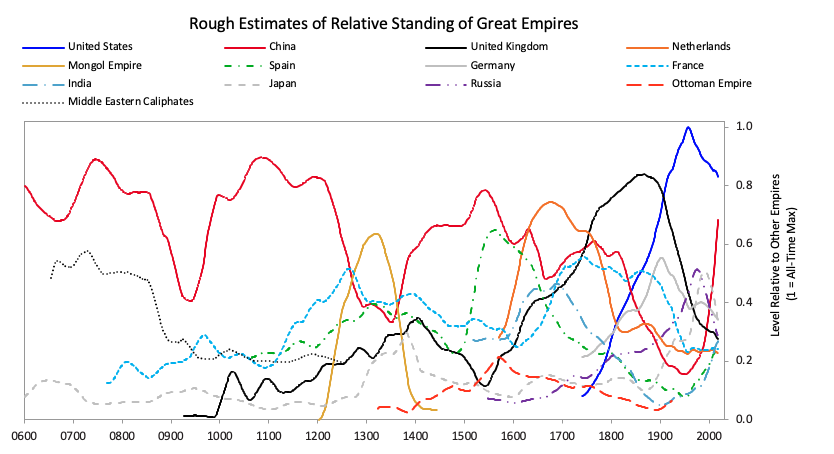

A lot of other people have presented a similar graph before. As you can see, China (the red line) has always been a big empire/country with strong standing in the world, except for the period from 1800 – about 1970. Many other empires rose and fell through history and it is perfectly normal.

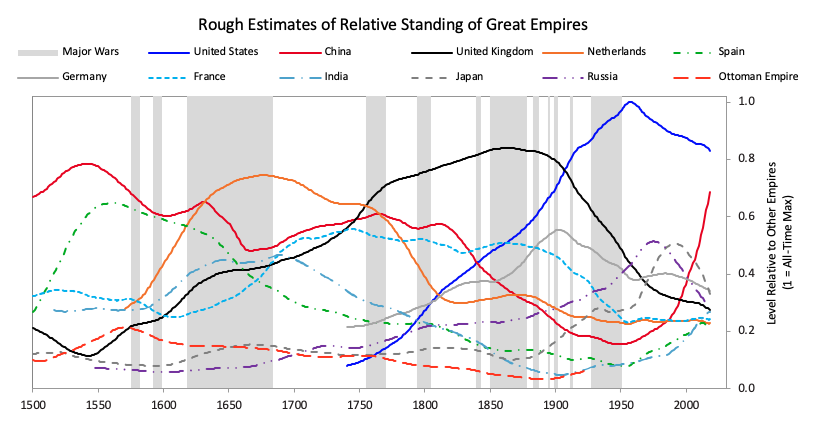

If we zoom into the last 500 years, this is what the graph looks like.

It is clear that the US (an incredibly young country) is in a strategic competition with China over the past 30+ years. Will this lead to hot war between the US and China in the next 20-50 years? Graham Allison has a book about this dynamic “Destined for War: Can America and China Escape Thucydides’ Trap?”. It is a good read and I recommend it.

Was the US at its “empire peak” back in 1950 – 1960?

Looking at the above graph, one can’t help but wonder whether the US has passed her prime and now in a slow decline relative to China? Is the decline reversible?

Well, Ray confirmed his thinking for us in his article The Big Cycle of the United States and the Dollar, Part 1. The US Empire peaked around the 1950s (in relation to other countries, not about its absolute power). Ray wrote, “At that time, the gap between the US and the rest of the world was at its greatest and the US dollar and the US world order became dominant.“

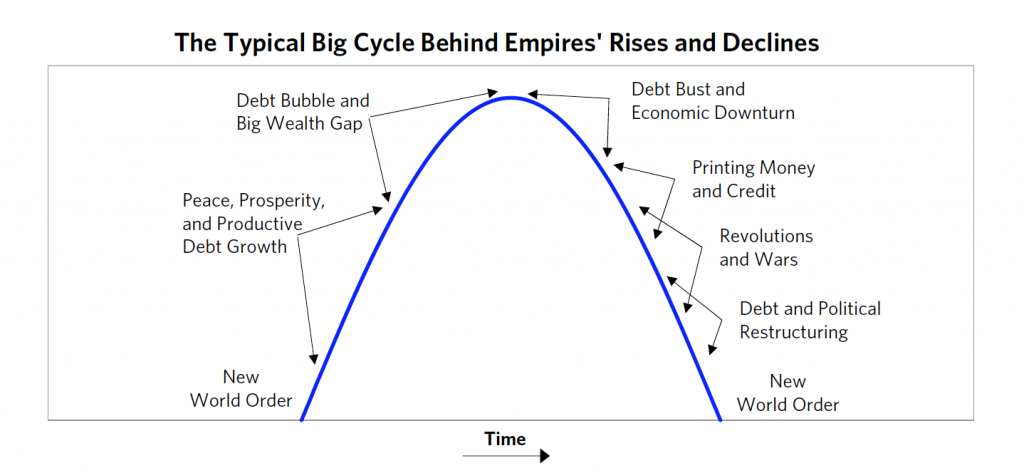

Below is an over simplification of the typical rise and decline of empires.

And in his latest article, “The Big Cycle of the United States and the Dollar, Part 2“, Ray went one step further and said that the “US is roughly 75% through that cycle, +/- 10%“. Obviously this has massive implications on geopolitics, world order, currency status, personal finance, etc.

What are the key factors contributing to an empire’s rise or fall in wealth and power?

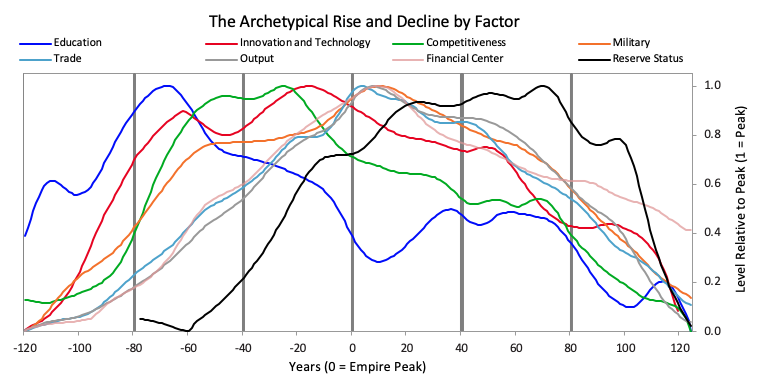

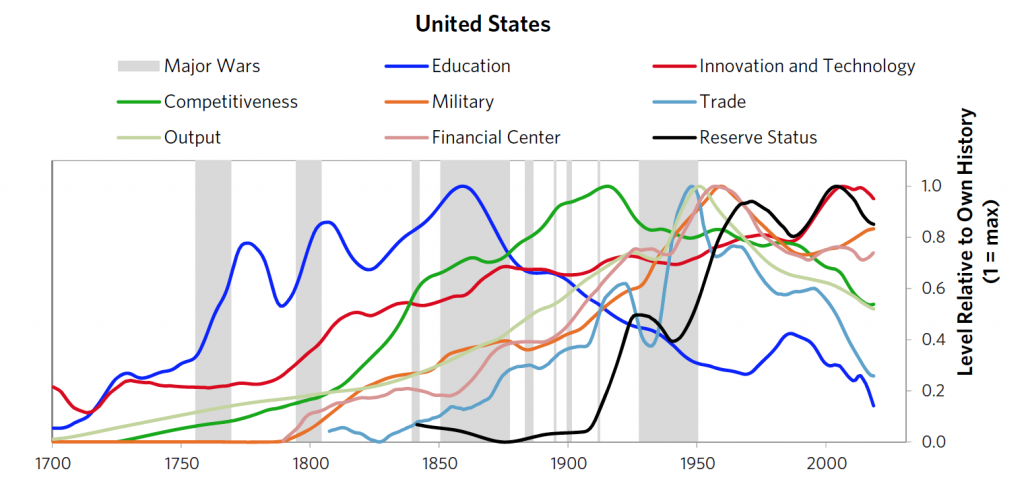

Ray and his team look at 8 types of power: 1) education, 2) competitiveness, 3) technology, 4) economic output, 5) share of world trade, 6) military strength, 7) financial center strength, and 8) reserve currency.

Overall, it seems that for each empire, a big cycle of rising and declining is about 250 years. Ray will tell you that this is an estimation and obviously each specific case can be a bit different.

Below is the graph of these 8 major type of powers for the US.

Education, Innovation and Technology are the two leading indicators.

So I am looking forward to seeing the next article from Ray in this series. I hope that Ray can share the individual country profile (US and China) with regard to the 8 factors above.

The US education curve

Also, given that education is such an important factor, it will be good to deep dive into education and unpack it a bit more. How did Ray and his team come up with the “education curve” for the US and China and other countries? What are the key components within the Education score? A few facts that we know about education are:

- The US’ PISA score has been stagnated over the past 20 years. (PISA score is probably the world’s most comprehensive and reliable indicator of 15-year-old student capabilities. PISA 2018 scores and insights are here).

- Students in the US rank 15th in reading, outside the top 30 in maths, outside of the top 15 for science.

- US universities consistently rank top of the world according to QS ranking.

- Hundreds of thousands of Chinese students studying abroad every year. Stats from China Ministry of Education are here.

The US innovation curve is still going very strong

In contrast with the education curve, US innovation is still going very strong, relative to China and other major countries. Again it will be good to understand how Ray and his team came up with this curve, the underlying components, and data sets.

It also begs the question of whether these trends can be changed, improved?

Share this with a friend

If you enjoyed this article and found it valuable, I’d greatly appreciate it if you could share it with your friends or anyone else who might be interested in this topic. Simply send them the link to this post, or share it on your favorite social media platforms. Your support helps me reach more readers and continue providing valuable content.

Ray Dalio’s recent sharing/thoughts about the changing world order

Sep 2024 : Ray Dalio’s 2024 Great Powers Index

This new report is packed with insights on the trajectory of 24 major nations and gives us a detailed outlook on their power dynamics over the next decade. I wrote about it here.

Oct 20, 2023: Assessing Ray Dalio’s Latest Warnings on Geopolitical Tensions

Ray Dalio has recently published two more articles on LinkedIn that double down on the cautious, even alarmed view he has espoused about rising global conflicts in past writings. Dalio sees events like the Israel-Hamas war and Russia’s invasion of Ukraine as steps toward an outright major power war, most worryingly between the US and China. Read more here.

Jun 19, 2023: Summary of Ray Dalio’s Jun 2023 conversations with Thomas Friedman and Bloomberg Invest

In June 2023, Ray Dalio, the founder of Bridgewater Associates, participated in two insightful conversations that shed light on the changing world order.

Apr 26, 2023: “The United States and China are on the brink of war and are beyond the ability to talk.”

Ray just published his latest post today. And boy 🙁 his message is direct and blunt. As usual, this is my summary and thoughts about the topic.

Apr 19, 2023 update: Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder

Ray published his latest insight about Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder on LinkedIn. This is the summary of the post and my perspective on it.

Relative empire standings across major countries Jan 2023

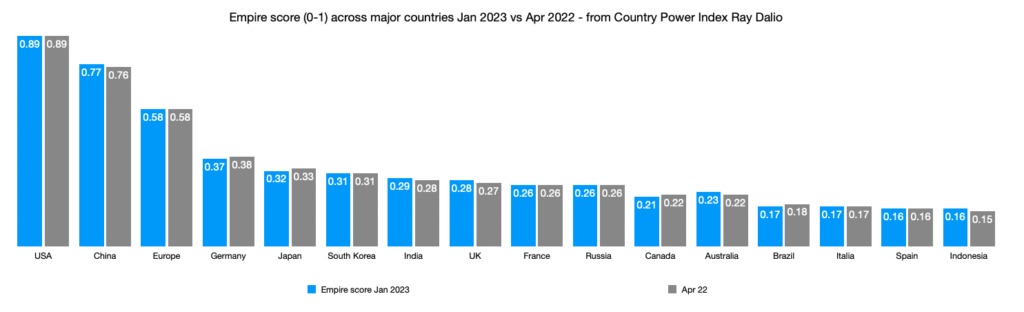

Ray updated the country’s power index again in 2023. The download is here from the usual economic principles website.

Below is the graph comparing the empire scores across countries and also their scores between Apr 2022 and Jan 2023. As expected, we don’t expect major changes in each country’s score.

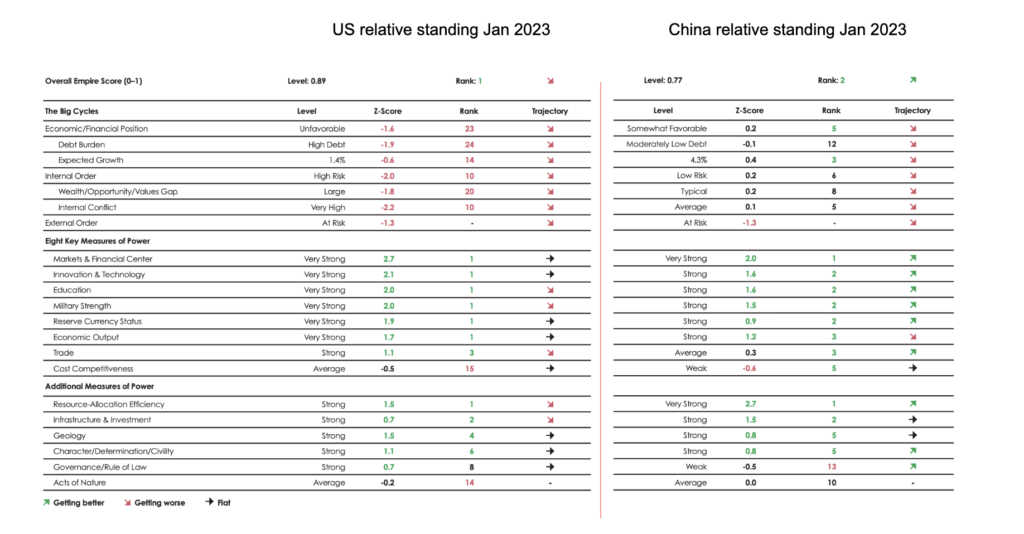

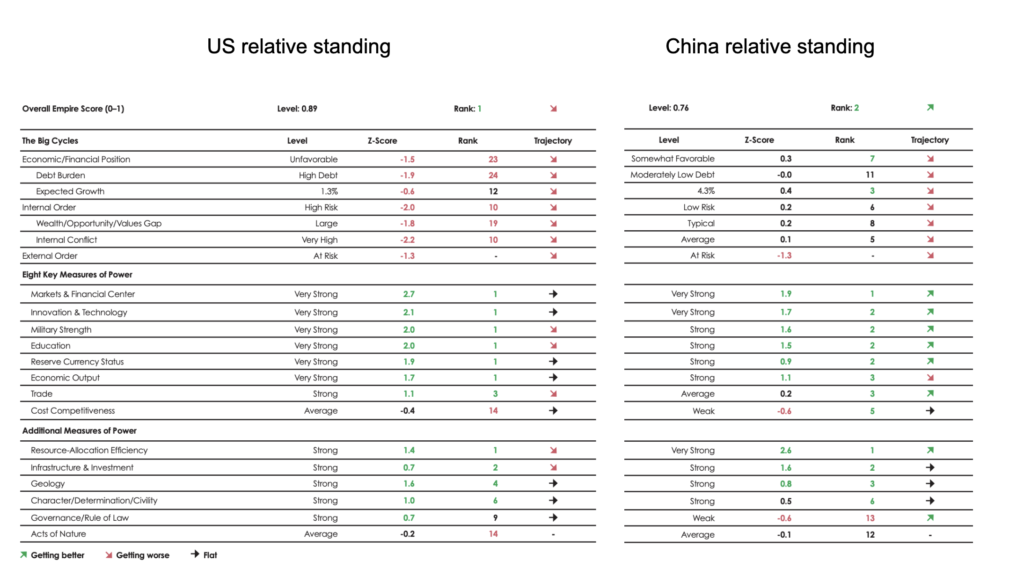

The relative comparison between the US and China in Jan 2023 is below. Data is from the same source above.

Mar 2023 update

Given the recent Silicon Valley Bank collapse in Mar 2023, Ray shared his insights about what is to come in the US in the next one or two years on LinkedIn. And here is the summary.

Feb 2023 update

The Alarming Probabilities of Disruptive Conflicts and Wars, as Predicted by Ray Dalio

Jan 2023

My thoughts on Ray Dalio’s recent dialogue on the Center for China and Globalization on Jan 10, 2023

Nov 2022

China’s “Dangerous Storm” Coming: My reaction to Ray Dalio’s post “China’s “Dangerous Storm” Coming: The Eight Big Challenges Facing China and the People Chosen to Deal with Them”

The changing world order is approaching stage 6 (the War stage).

The relative standing of great empires Apr 2022

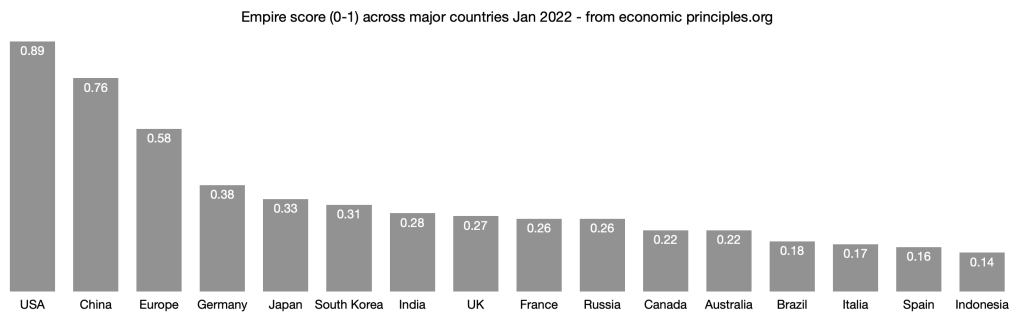

Based on the data from the country power index Apr 2022, we can see the relative standing of great empires as of Apr 2022 below:

When we put the detailed individual scores for the US and China next to each other, we see this as of Apr 2022.

We can see that while the gap between the US and China is reducing across many scores, the US is still very strong in education, trade, innovation & technology, military strength, etc… China’s economic/financial position, and internal order (wealth/value gap, internal conflict) are significantly better than the US.

20 Mar 2022 update

Ray published his book, and here is my review of “Principles for dealing with the changing world order”

The book is also in audio format if you prefer to listen to it.

Ray also published a video about “Principles for dealing with the changing world order“. It is a good summary of the book. The video is short, about 45 mins so it’s worth a watch.

Jul 2020

My additional thoughts on “The Big Cycle of the United States and the Dollar, Part 1” by Ray Dalio

How to apply Ray Dalio sharing to your personal finance?

Given Ray’s sharing about the changing world order, and the rise and fall of an empire, which relates to asset price, currency reserve status, the value of gold, etc, how can we apply his teachings to personal finance?

His main recommendation is diversification. I wrote more about this topic in “How to apply Ray Dalio’s sharings to your personal finance“:

- Basic level: pay your debt, especially those with a 10%+/year interest rate

- Be a bit more defensive in your approach, given the continued volatility

- Diversification in asset class, geography, and currency.

- Build a simple personal finance dashboard.

Cheers,

Chandler

[jetpack_subscription_form]

Saludos y gracias por informar

🙂