Yesterday, Ray Dalio published the latest chapter titled “Chapter 4: The Big Cycle of the United States and the Dollar, Part 1“. Overall, it is a good read, even though it doesn’t include as many new ideas or insights as I hope it should. This is partly because I have been following Ray’s public sharing for a while, including many of his recent interview with Bloomberg, TED, Goldman Sachs, etc. If you haven’t been reading or watching Ray’s writing/talks, then there is plenty of new information, insights in this article (or the whole series) for you.

1. What I have learned from the article

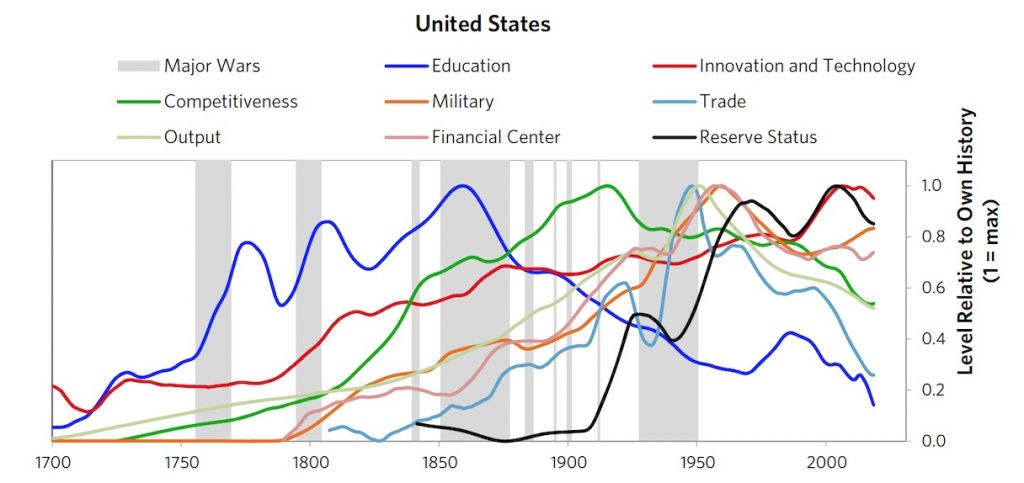

- My interpretation of the first article in the series “the big picture in a tiny nutshell” is correct. Ray also thinks that the US Empire reached its peak around the 1950s and it has been in a relative decline since.

- How similar what we are experiencing right now is to the period from the 1930s – 1945. Ray has said this many times before but I didn’t appreciate its meaning until I saw the details included in this article. Obviously, this is a cause for great concern. For examples:

- We are seeing a lot of these revolutionary pressures within the US (wealth gap, racial gap, social injustice protest, call for a fundamental change to policing, etc.), the UK and many other countries at the moment.

- The rise of nationalism, populism, and autocratic leadership across many countries.

- The interest rate is hitting zero and countries around the world are printing money to pay for many obligations.

- Economic war between countries as they are trying to fight “for greater shares of a shrinking economic pie.”

- The US is, again, turning to protectionist to safeguard jobs, so it raised tariffs like what it did in 1930 (via the passage of the Smoot-Hawley Tariff Act).

- Many of the classic economic warfare techniques are being used/talked about:

- Asset Freezes/Seizures: some top US policymakers are now talking about not paying our debts to China.

- Blocking Capital Market Access: the US now issuing threats of doing this to China.

- Embargoes/Blockades: Blocking trade in goods and/or services either in one’s own country, or in some cases with neutral third parties, for the purpose of weakening the targeted country or preventing it from getting essential items. We are seeing this with the technology war going on between the US and China.

- “Consider the following three big choices that one has to make in order choose a country’s approach to governance: a) bottom-up (democratic) or top-down (autocratic) decision-making, b) capitalist or communist (with socialist in the middle) ownership of production, and c) individualistic (which treats the well-being of the individual with paramount importance) or collectivist (which treats the well-being of the whole with paramount importance).“

- This is such a concise and powerful note.

To be fair, Ray is not the first person or the only person to raise the alarm bell. Many other thinkers have said these recently too like Graham Allison in his book “Destined for War: Can America and China Escape Thucydides’ Trap?” or Kevin Rudd (the former Prime Minister of Australia), etc.

2. Ray & his team to release raw data behind their analysis of the eight major types of power and the 17 drivers behind them

Given that Ray has been extremely open with his sharing, I hope he does share. I understand that considerable effort has been spent on collecting and processing the data set. The main reason is that I want to analyze deeper, using different graphs than what he has been providing through this series. For example,

- The education curve: What methodologies do Ray and his team use to calculate a relative education curve like that? This will help to explain the recent bump in the US relative education strength around 1980s?

- The competitiveness curve: US competitiveness has been in relative decline since 1930s. Why is that? Is there something policymaker in the US can do to reverse the trend?

3. How to apply Ray’s sharing to personal finance?

Given what Ray has consistently shared with us, how we then apply his sharing to our personal finance? I wrote more about this topic last week before this article came out. I still think they are very relevant so here is the link.

That’s all from me for today. How about you? Do you agree or disagree with any of the points raised?

Chandler