In his book, “Principles for Dealing with the Changing World Order”, hedge fund manager and billionaire investor Ray Dalio explores the major shifts in the global order and offers his thoughts on how to navigate them.

Dalio argues that the world is undergoing a major transition, with the U.S. losing its status as the dominant power. He believes that this shift will have far-reaching implications for both the American economy and global geopolitics.

Table of Contents

- So what did I learn from this book and the website?

- A more detailed version of the empire cycle is below

- We need the US and China empire stats to be updated continuously and shared with the public

- Share this with a friend

- Ray Dalio’s recent sharing/thoughts about the changing world order

While Dalio’s predictions may be controversial, his book provides an insightful look at the changing world order and is well worth a read. The book has an accompanying website https://economicprinciples.org/. One of the biggest comments from me previously was that I wished he could share more raw data or make the graphs more precise so that we can interpret/gauge the timing better. He did that and even more with the book and the website. He also shared this summary video recently “principles for dealing with the changing world order“. So if you don’t have a lot of time and just want to get the gist of the book, the video is a good option. Or if you prefer to listen to the audio version of the book, here it is. All the graphs or quotes below are from the book or the website.

(FYI, you can download all the graphs in the book here).

So what did I learn from this book and the website?

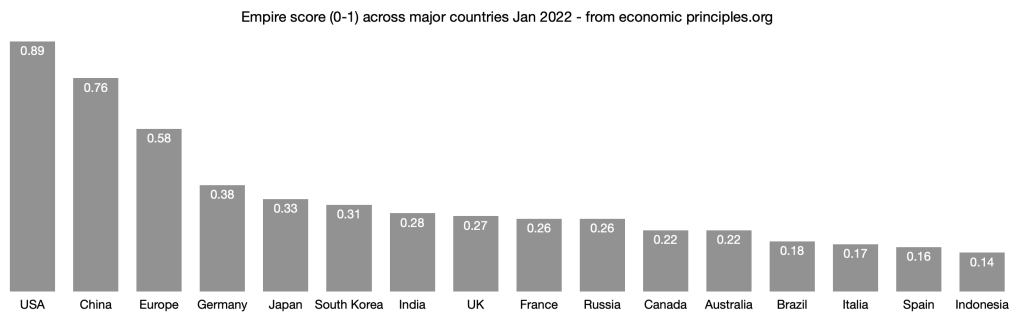

- The US is now at about 70% of a typical great empire cycle, give or take 10%. They are in the decline phase of the cycle.

- China is on the other hand, in the rise phase of the cycle.

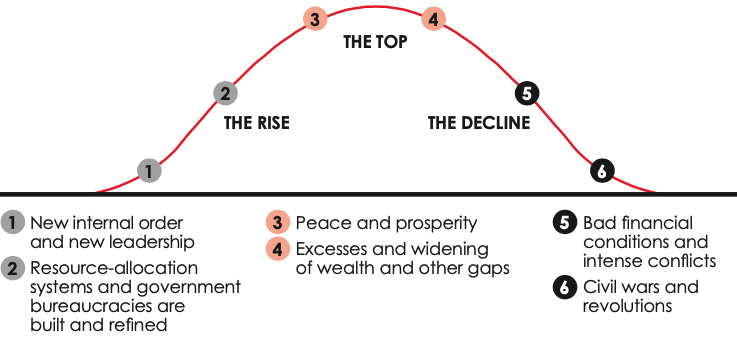

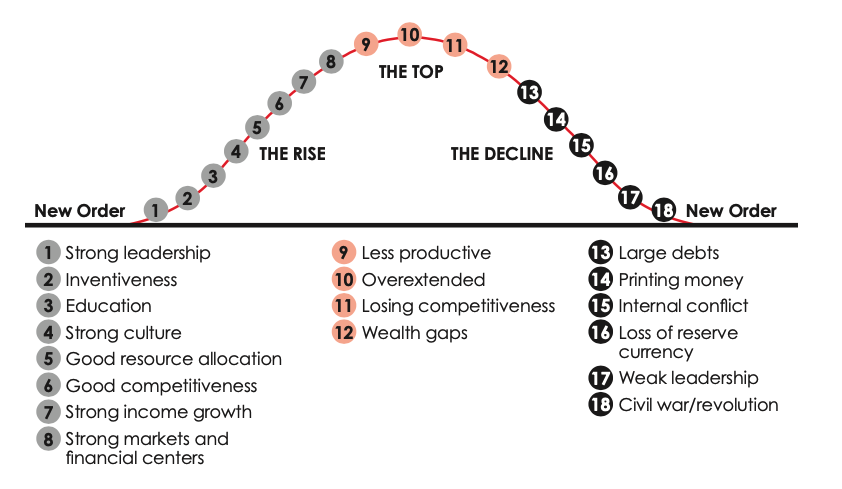

A more detailed version of the empire cycle is below

If you go deeper a bit, the story is a lot more nuanced than you think. Using the data from the “country power index Apr 2022“, we can see that while the US is in relative decline, it is still very strong as an empire in comparison to China and extremely strong compared to other countries

Ray and his team break down the overall empire score into its individual components and share their readings on the same website. What I would love to see here is a Peer review! I don’t have the capacity, expertise or bandwidth to do a thorough peer review of the data Ray and his team published on https://economicprinciples.org, but someone should!

This way, we can have a much more meaningful debate, validate Ray’s findings/scores, or dispute it.

When we put the detailed individual scores for the US and China next to each other, this is what we see as of Apr 2022.

We can see that while the gap between the US and China is reducing across many scores, the US is still very strong in education, trade, innovation & technology, military strength, etc… China’s economic/financial position, and internal order (wealth/value gap, internal conflict) are significantly better than the US.

We need the US and China empire stats to be updated continuously and shared with the public

The immense value that I have gained from the above simple table is that:

- Some people only talk about the high indebtedness of the US, the money printing, the internal disorder (large wealth/opportunity/values gap) and conclude that the US is heading for trouble at any moment now.

- On the flip side, some people cite very strong education (with most global leading universities are in the US), high level of innovation, strong financial center, many of the most valuable companies in the world are US MNCs, etc… as examples of the US strength and dismiss the idea that the US in in decline.

- Well they are both right and wrong 🙂 both side look at part of the picture and not the whole picture. And they are not looking at the speed of change (speed of increase or decrease) and the direction of change also.

- This systematic way of seeing things is highly valuable so thank you very much Ray and his team!

If you ask me what I don’t like about the book and I have to nitpick, it is about the use of words like “timeless” or “universal”. What Ray shares in the book are about history, human beings, not the law of nature, not physics or math so I think the use of words like “timeless” is not warranted. But again, this is a very minor detail and it doesn’t impact my overall impression of the book that much.

Share this with a friend

If you enjoyed this article and found it valuable, I’d greatly appreciate it if you could share it with your friends or anyone else who might be interested in this topic. Simply send them the link to this post, or share it on your favorite social media platforms. Your support helps me reach more readers and continue providing valuable content.

Ray Dalio’s recent sharing/thoughts about the changing world order

Sep 2024 update: Ray Dalio’s 2024 Great Powers Index and What Lies Ahead

Check out the latest sharing from Ray, including the updated power index across countries and my thoughts on them here. Here’s what you’ll find:

1. Key insights from Ray’s comprehensive 200-page report on global power shifts

2. A custom GPT assistant to help you explore and answer any questions you have about the report

3. How ChatGPT 4.0 powered the creation of all the visuals in the post

Apr 19, 2023 update: Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder

Ray published his latest insight about Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder on LinkedIn. This is the summary of the post and my perspective on it.

Mar 2023 update

Given the recent Silicon Valley Bank collapse in Mar 2023, Ray shared his insights about what is to come in the US in the next one or two years on LinkedIn. And here is the summary.

Feb 2023 update

The Alarming Probabilities of Disruptive Conflicts and Wars, as Predicted by Ray Dalio

Jan 2023

My thoughts on Ray Dalio’s recent dialogue on the Center for China and Globalization on Jan 10, 2023

Nov 2022

China’s “Dangerous Storm” Coming: My reaction to Ray Dalio’s post “China’s “Dangerous Storm” Coming: The Eight Big Challenges Facing China and the People Chosen to Deal with Them”

The changing world order is approaching stage 6 (the War stage).

That’s all from me. Let me know what you think via the comments below.

Chandler

P.S.: if you want to listen to the conversations between Ray Dalio and others (like Henry Kissinger, Larry Summers, Fareed Zakaria, or Hank Paulson) you can watch those Youtube videos here.

P.P.S: Since I have written about Ray Dalio’s sharing many times over the years, if you want to ask some questions about a specific topic, you can use the chatbot that I recently built here.

[jetpack_subscription_form]