Ray Dalio recently wrote an article warning that we are approaching stage 6 of the changing world order. This stage is characterized by war, and it could have a devastating impact on individuals, countries, and businesses. So how worried should we be?

Update Sep 2024: In Sep 2024, Ray and his team released another report with updates about Great power indexes. You can check out the key insights and my thoughts here.

Given that Ray (and his team) are highly analytical in their approach, my general assessment is that we should be very worried. Ray even gave a rough timing :

“To be clear, when I say that I believe we are on the brink of civil and/or international war, I am not saying that we will necapprehensiveinto them or that, if we do, it will happen very soon. What I am saying is that the different sides in domestic and international conflicts are preparing for war and if events are allowed to progress as they typically do, there is a dangerously high probability of us being in at least one of these wars if not both in about five years, give or take about three (with the highest risk point being in 2025-26).“

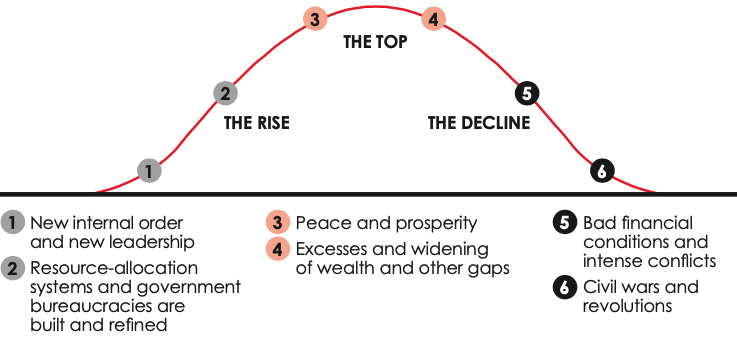

If you are not familiar with Ray Dalio’s framework of the 6 stages of the Big cycle, he wrote about it extensively in his book. (My review of the book is here).

In the article, Ray shared anecdotal evidence of why he thinks the cycle is accelerating “which has raised the odds of moving to Stage 6 (the civil war/war stage) to uncomfortably high levels.“

Generally, I agree with those observations. What I love to see is ,the analytical model that leads Ray and his team to believe that 2025 – 2026 is the highest-risk period. Also, I would love to see an updated version of the country power index. The last time the data was shared publically was back in Apr 2022. This will help us to dig deeper into the model and validate the findings.

The second half of his post is about diversification for investors (big or small), which has been a consistent message from Ray over the years.

Interestingly, he published this article on Nov 1st, less than 1 week before the supposedly “consequential” US mid-term election. And then the next day, he published a more upbeat article titled “Not Only Can We Avoid War But We Can Have the Best Times Ever“. I have found the second article to be a bit “forced”. It was as if after the first article, people told Ray that it was too realistic, too sobering and it was not good for certain party in the mid term election. I have no particular insights here, just a gut feel.

What do you think? Do you agree with Ray’s assessment of the changing world order?

Are you worried about the possibility of war? What are you doing to prepare?

Let me know in the comments.

Chandler

[jetpack_subscription_form]

So what does an American in their 60’s, with a few million in savings, and ready to retire do to survive the 6th stage that could well happen in the next 10 to 20 years? Is it gold, crypto, a farm in the county, or an entirely different country that is in an earlier stage of the cycle?

Hi Thomas,

First, thank you for reading the post and sharing your question. Second, if that is a question for me, I am hesitant to offer any specific replies as I don’t think I am qualified to give any advice.

Ray Dalio offers some general guidance for investors in the second half of his article. The main idea is diversification in asset class (stock, bonds, commodity, etc…) and countries (both advanced and emerging markets). While it is true that emerging markets are at a different stage of the cycle, they do carry other risks (from political to currency, balance sheet, etc…), and we don’t know the secondary effect of big power rivalry on smaller countries.

What history did show is that in war, most countries implemented many extreme financial measures from market closure, asset price control, FX control, etc…

For me, my personal financial situation is different than yours so I will continue to observe the trend carefully and be prepared for extreme diversification if it comes to it 😐