For those who are familiar with Ray Dalio’s writing, his latest chapter “The big cycles over the last 500 years” is a treat. Ray goes deep into the weeds and shows us in details:

- The rise & decline of the Dutch Empire and the Dutch Guilder

- The rise & decline of the British Empire and the British Pound

- The Rise of the American Empire and the US Dollar After World War I

Update Sep 2024: I’ve just published a deep dive into Ray Dalio’s latest Great Powers Index (Sep 2024) on my blog. Here’s what you’ll find:

- Key insights from Ray’s comprehensive 200-page report on global power shifts

- A custom GPT assistant to help you explore and answer any questions you have about the report

- How ChatGPT 4.0 powered the creation of all the visuals in the post

Update 2022: since I wrote this post, Ray actually published his book about this topic under the title “Principles for Dealing with the Changing World Order“.

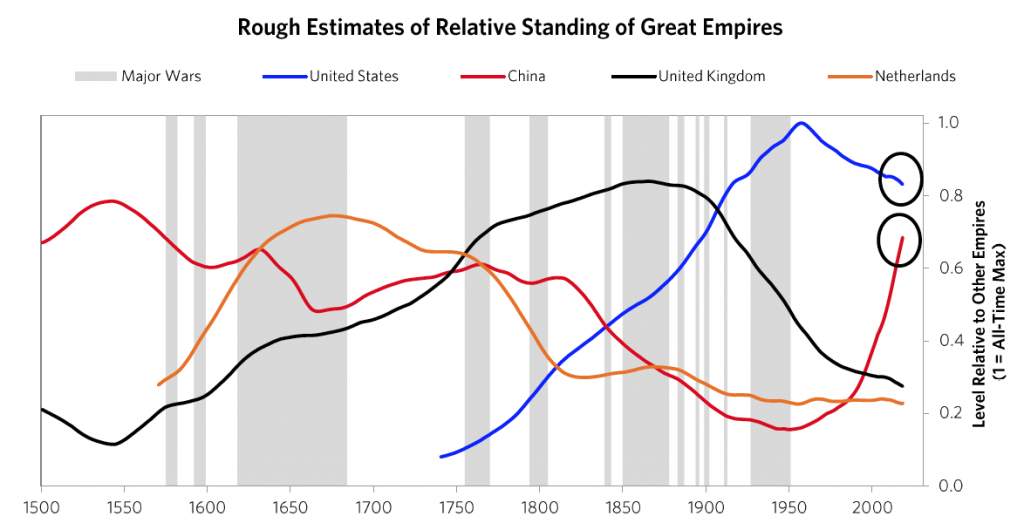

The chapter’s overarching theme is similar to Chapter 1 The big picture in a tiny nutshell. The rise and fall of an empire and their reserve currency status follow similar cycles. By studying past cycles, we can have a framework to understand the strategic forces at play globally today. Each cycle is long (about 250 years) so it is not surprising that no one has direct experience through the entire cycle or even half of it. This doesn’t mean everything is unprecedented.

Ray Dalio’s work reminds me of Graham Allison’s book “Destined for War: Can America and China Escape Thucydides’ trap“. While both include historical events over the past 500 years, Graham’s book talks more about geopolitics, public policy while Ray’s focuses on the economy and reserve currency status. Both thinkers conclude that we are in a very dangerous period and conflicts could happen.

Ray wrote this recently: “From studying history and comparing it with where we are I believe that we are seeing a current confluence of 1) high levels of indebtedness and extremely low-interest rates (which limits central banks’ powers to stimulate the economy), 2) large gaps in wealth, values and politics within countries (which leads to increased conflicts within countries), and 3) rising world powers (most importantly China) challenging the existing leading world power (the US), which causes external conflict.“

As I think more about they write, I have my own questions like:

- The future is not preordained, so it means we (political leaders, political parties, citizens, each of us) can take action to change the current course of history that we are on. This is the conclusion that Graham reaches in his book too.

- Ray wrote, “To be clear, I didn’t start out trying to make an argument and then go looking for stats to support it; doing that doesn’t work in my profession as only accuracy pays.” and I believe him. So, it is critical to see other pieces of evidence to support the opposite argument from his. For example,

- It is not like the Dutch, or the British purposely wanted their Empire to follow the cycle mechanics and fall. I am sure they did what they thought was best at the time to reverse the tide. So what went wrong? War with other countries certainly played a part here, but was that all?

- It would be great to look through attempts by the Dutch and the British to reverse the tide. What lessons can we learn there?

- Education is the leading indicator of the eight factors Ray mentioned. So what happened to the Dutch and British education? Did the rest of the world catch up with the level of education that the Dutch and the British provided to their citizen?

- Can the US reverse the relative decline that it is currently in, especially with regards to China? It is hard to do given the size of the population unless a US citizen’s average productivity is more than 5 times that of the Chinese.

- What is the role of innovation in shaping/changing the cycle? especially automation, genetics, bioengineering, and artificial intelligence.

- As a civilization, China has gone through not just 1 cycle but multiple cycles in its long history. It would be illuminating to analyze how China has journeyed through multiple rise/fall cycles. Perhaps, Ray can go further back over the past 3000 years of Chinese history and help us see the fuller truth :). Does his framework still hold in that situation?

Lastly, Warren Buffett in this year’s annual shareholder meeting went out of his way to use history to express his optimism for the future of the US. It is true that what the US is going through now is definitely not the darkest moment in its relatively short history. (I recommend this book These Truths: A History of the United States)

So what does this leave us? What are the recommendations at the public policy level and personal level for the US, China, and other major powers in the world? It may be wishful thinking but I would love to have a panel discussion between:

- Ray Dalio

- Graham Allison

- Warren Buffett

- Kevin Rudd because of his deep understanding of China and its culture

Share this with a friend

If you enjoyed this article and found it valuable, I’d greatly appreciate it if you could share it with your friends or anyone else who might be interested in this topic. Simply send them the link to this post, or share it on your favorite social media platforms. Your support helps me reach more readers and continue providing valuable content.

The panel format should follow the Joe Rogan Experience Show format: long-form, quiet moderator to let these global thinkers debate amongst themselves and express their thoughts without time constraint or interruption every 3-5 mins. Perhaps Bill Gates can be the moderator :).

[jetpack_subscription_form]