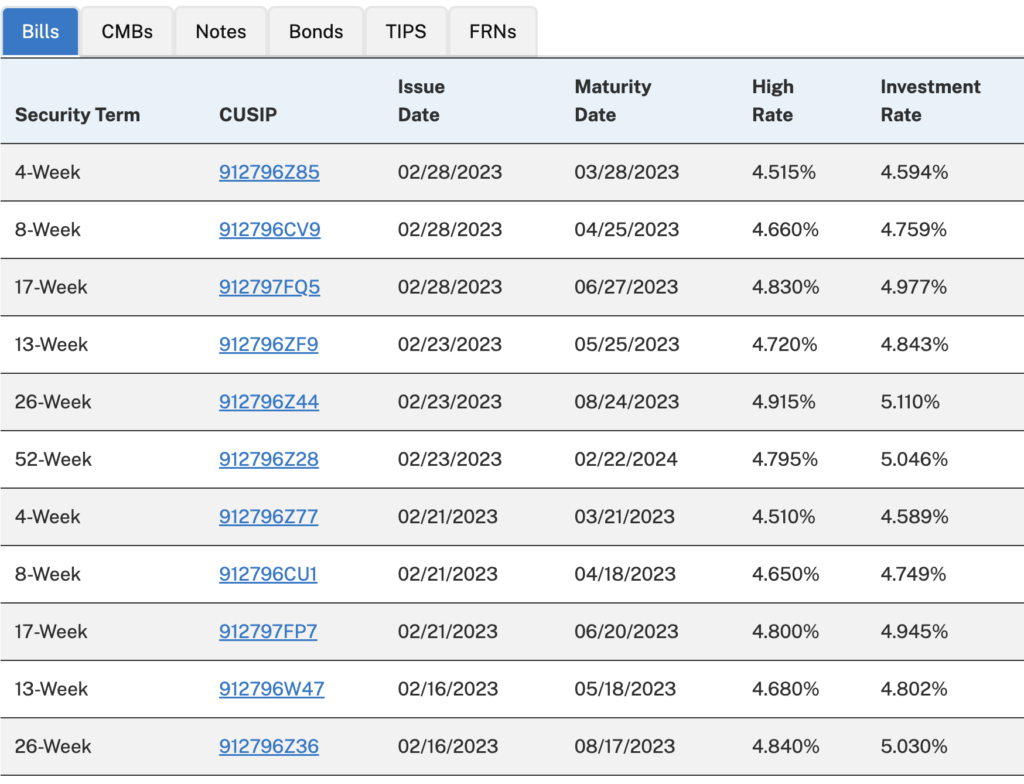

The title is not meant to be exaggerated. The interest rates for US Treasury bills for a 4-week term have been more than 4.5% annual percentage yield (APY). You can check the rates from the official Treasury Direct website here.

Something is wrong if you are not earning at least 3% APY on your savings

Many high-yield accounts now offer 3%+ APY or 3.5% APY. So take advantage of those for your savings money. (I wrote another article about high-yield saving account for expats here.)

A portion of the money can be used to buy Treasury Bills to earn higher interest. For Treasury Bills, “this interest is subject to federal income tax, but is exempt from all state and local income taxes.” according to the IRS website. Because of this exemption, if you live in a state with a high state income tax (like California), interest earned from Treasury bills is much better than those from high-yield saving accounts.

You can see from the auction results above that, with longer-duration Treasury Bills, the APY can be 4.7% or 4.8%.

In December 2022, I wrote about Treasury Bills’ basic information for expats in the US. So if you haven’t bought US Treasury Bills in the past (directly or via a broker), I encourage you to read that article first.

You can invest as little as $100 using Treasury Direct

At the time of this writing (Feb 20223), the minimum amount for each Treasury Bills purchase with Treasury Direct is $100. So this is quite friendly to retail investors like me.

If you buy through your brokers, many of them have a minimum purchase amount of $1000 for Treasury Bills, so please check with yours directly using their website.

Another feature that I like is the auto reinvest at maturity. This feature is offered by many brokers and also by Treasury Direct. It is convenient because you don’t need to think about it with this pot of money.

But what’s the catch?

First of all, with inflation at 6.4% for the month of Jan 2023, 4.5% APY means that you are losing purchasing power. Your real interest rate is -1.9%, so that is the biggest catch.

Second, there may be a minimum holding period depending on where you buy Treasury Bills (or Bonds). For example, “In Treasury Direct, when you buy a Treasury marketable security, you must hold it in your TreasuryDirect account for 45 days before selling or transferring it. This means you can’t sell or transfer a 4-week bill from TreasuryDirect because it matures in less than 45 days. This hold also applies to a reinvestment when new funds are added to pay for the new security.” So only use the amount of savings that you can afford to hold for at least four weeks, if you buy from Treasury Direct. As for buying Treasury Bills via your brokers, please check their websites.

Third, if you have questions about whether you should buy a 4-week, 26-week, 52-week or longer duration treasury bill/bond, it is really up to each personal situation and preference. So I can’t comment on that. Unless you have millions of dollars to invest, a 0.2 or 0.3% difference in APY doesn’t matter much, so I often make decisions based on my preference.

Fourth, should you buy Treasury Bills via Treasury Direct or a brokerage account? Again, sorry, you need to do your own research because each person’s situation is so different that it is hard to write anything meaningful here.

Conclusion

If you don’t currently have money in a high-yield saving account, then, of course, open a high-yield saving account. Prioritizing safety first is my recommendation when choosing which financial institution to use.

Then don’t keep all of your savings money in the high-yield saving account, use a portion of it for Treasury Bills can give you a better return.

As always, tax in the US is complicated, so do your own research carefully or engage with a professional.

[jetpack_subscription_form]