If you’re an expat living in the US, navigating the healthcare system can be frustrating. One increasingly popular option is the high deductible health plan (HDHP). At first glance, an HDHP may seem like a risky choice due to the high out-of-pocket costs. However, with lower monthly premiums and potential tax benefits, an HDHP can be a cost-effective way to manage your healthcare expenses. In this article, we’ll dive into the world of HDHPs, exploring their benefits and drawbacks, considerations for choosing one, and tips for making the most of it.

(Before we start, as with any financial decision, please do your own research carefully to make an informed decision. Also, the information written in this article is subject to change in the future without notice. The article is for informational purposes only.)

What is a High Deductible Health Plan?

First, let’s define what a High Deductible Health Plan (HDHP) is. According to the IRS, an HDHP has:

- “A higher annual deductible than typical health plans, and

- A maximum limit on the sum of the annual deductible and out-of-pocket medical expenses that you must pay for covered expenses. Out-of-pocket expenses include copayments and other amounts, but don’t include premiums.”

An HDHP may provide preventive care benefits without a deductible or with a deductible less than the minimum annual deductible

The deductible is the amount you pay out of pocket before your insurance starts covering your medical expenses. Once you reach your out-of-pocket maximum, your insurance will cover 100% of any additional covered medical expenses for the remainder of the year.

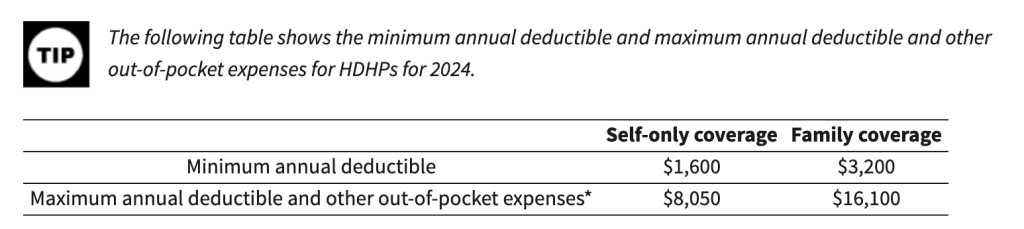

For 2024, according to the IRS for HDHP:

One key feature of an HDHP is that it is often paired with a Health Savings Account (HSA). An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses, such as deductibles, copays, and prescriptions. Contributions to an HSA are tax-deductible, and the funds can grow tax-free over time. Additionally, withdrawals for qualified medical expenses are tax-free, making HSAs a powerful tool for managing healthcare costs.

Now that we’ve defined HDHPs and HSAs, let’s explore some of the benefits of choosing an HDHP.

Pros of HDHPs

Lower Monthly Premiums and Potential Tax Benefits using HSA

One of the main advantages of an HDHP is that it typically has lower monthly premiums compared to traditional health insurance plans. This can make an HDHP an attractive option for those who want to save money on their healthcare costs. Additionally, contributions to an HSA are tax-deductible, which can further reduce your tax burden. This can be especially beneficial for expats who may have a higher tax liability in the US.

For example, if you plan to contribute $5000 per year to HSA and your top marginal tax rate is 25%, you save $1,250 from tax payment.

Encourages Preventive Care and Healthy Behavior

Since HDHPs typically have high deductibles, they can encourage individuals to be more proactive about their health and seek out preventive care services. Because otherwise, you pay a lot of money for healthcare services T.T, especially in the US.

Many HDHPs offer preventive care services at no cost, such as annual check-ups, cancer screenings, and vaccinations. Additionally, some HDHPs offer wellness programs and incentives for healthy behavior, such as discounts on gym memberships or rewards for meeting fitness goals.

From IRS, preventive care includes, but isn’t limited to, the following.

- Periodic health evaluations, including tests and diagnostic procedures ordered in connection with routine examinations, such as annual physicals.

- Routine prenatal and well-child care.

- Child and adult immunizations.

- Tobacco cessation programs.

- Obesity weight-loss programs.

- Screening services. This includes screening services for the following.

- Cancer.Heart and vascular diseases.Infectious diseases.Mental health conditions.Substance abuse.Metabolic, nutritional, and endocrine conditions.Musculoskeletal disorders.Obstetric and gynecological conditions.Pediatric conditions.Vision and hearing disorders.

Motivate you to shop around for healthcare services

Given the high deductible, in a weird way, HDHP motivates you to shop around for different healthcare services. Or just to research more about different options near by. The cost for the same service, with relatively the same quality between different providers can be 5x or 10x and I am not kidding. You can read more about the different predatory practices from this book “The Price we pay” by Marty Makary, MD. It is a New York Times best selling book.

While there are some benefits to choosing an HDHP, there are also some drawbacks to consider. We’ll explore those next.

Cons of HDHPs

Higher Out-of-Pocket Costs for Medical Expenses

The first one is obvious. One of the main drawbacks of an HDHP is the higher out-of-pocket costs for medical expenses. Since HDHPs have high deductibles, you’ll need to pay more out of pocket before your insurance starts covering your medical expenses. This can be challenging for individuals with chronic conditions or unexpected medical events that require frequent medical care.

Delayed or Avoided Care Due to Cost Concerns

Another potential drawback of an HDHP is the risk of delayed or avoided care due to cost concerns. Some individuals with HDHPs may be hesitant to seek medical care for non-emergency conditions due to the high out-of-pocket costs. This can lead to delayed diagnosis and treatment, which can have serious health consequences in the long run.

More time spent on shopping for good healthcare options

As mentioned above, given the high deductible, it may motivate you to shop around to find better healthcare services. However, that shopping around takes time and energy, away from other things in life.

Considering these benefits and drawbacks, how can you determine if an HDHP is right for you? Let’s explore some considerations for choosing an HDHP.

Considerations for Choosing a HDHP

Personal Health and Financial Situations

One of the most important considerations when choosing an HDHP is your personal health and financial situations. If you are generally healthy and don’t anticipate needing frequent medical care, an HDHP may be a good option for you. On the other hand, if you have chronic conditions or anticipate needing frequent medical care, a traditional health insurance plan may be a better choice.

Anticipated Medical Expenses

Another important consideration is your anticipated medical expenses. If you anticipate needing frequent medical care or have high prescription drug costs, an HDHP may not be the most cost-effective option. However, if you are generally healthy and don’t anticipate needing frequent medical care, an HDHP may be a good way to save money on your healthcare expenses.

Availability of HSA-Eligible Plans and Contributions

If you are considering an HDHP, it’s important to check if the plan is HSA-eligible and if your employer offers an HSA contribution. HSA contributions/tax saving can help offset the higher out-of-pocket costs associated with an HDHP, making it a more attractive option.

Provider Network and Access to Preferred Providers

When considering an HDHP, it’s important to review the plan’s provider network and ensure that your preferred providers are covered. If you have a specific healthcare provider that you want to continue seeing, make sure they are in the plan’s network.

Employer Contributions or Incentives

Finally, if you are considering an HDHP through your employer, it’s important to review any contributions or incentives offered by your employer. Some employers offer contributions to your HSA or other incentives to encourage employees to choose an HDHP.

The above list is NOT meant to be exhaustive and healthcare is a deeply personal topic so please consider your situation carefully or talk to a professional.

Conclusion

In conclusion, high deductible health plans (HDHPs) can be a cost-effective option for managing healthcare expenses, especially when paired with a Health Savings Account (HSA). While there are some drawbacks to consider, such as higher out-of-pocket costs and more time/effort spent to find suitable providers, HDHPs offer several benefits, including lower monthly premiums and greater control over healthcare spending. If you’re an expat living in the US, it’s important to carefully consider your healthcare options and choose a plan that meets your personal health and financial needs. By being proactive about managing your healthcare costs and utilizing available resources, you can make the most of your HDHP and stay healthy while saving money.

[jetpack_subscription_form]