The news of the Silicon valley bank (SVB) collapse has been covered widely over the past few days in mainstream media. Some people started talking about the potential contagion of this event or the second or third-order effect. Obviously, this is a very tough situations for companies, founders, and depositors at the bank. The purpose of this article is to use actual search interest from the residents in California and other states to understand what are on people’s mind about this topic. Data for this article is mainly from Google Trends. Before writing this article, I didn’t know about the bonuses that SVB gave out to their team hours before the collapse on Friday.

I will continue to update the content of this article at the end as this event unfolds. So feel free to use the table of content below to jump straight to the latest content.

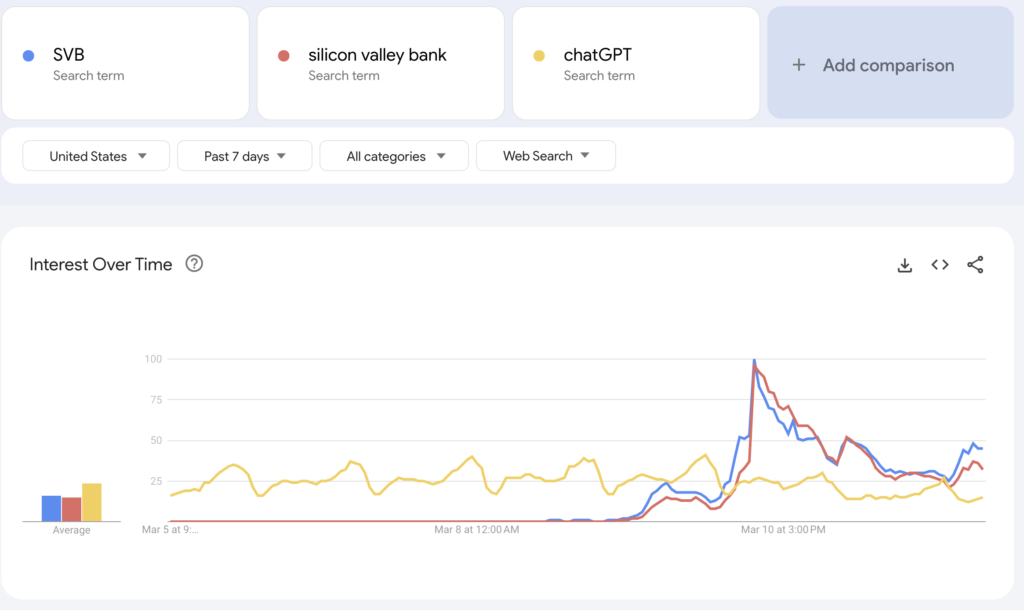

SVB news started to explode in the early morning Mar 9

The moment SVB news broke, it became the national news as seen on the graph above.

Why I am showing both chatGPT and SVB on the same chat, I want to understand the comparative interest between the two and I know that chatGPT is a very hot topic in the US.

I didn’t know that the interest was 4x chatGPT the moment the news broke.

In hindsight, it seems obvious because people are worried about their own money or their pay check so the interest in SVB should be a lot higher, than SVB.

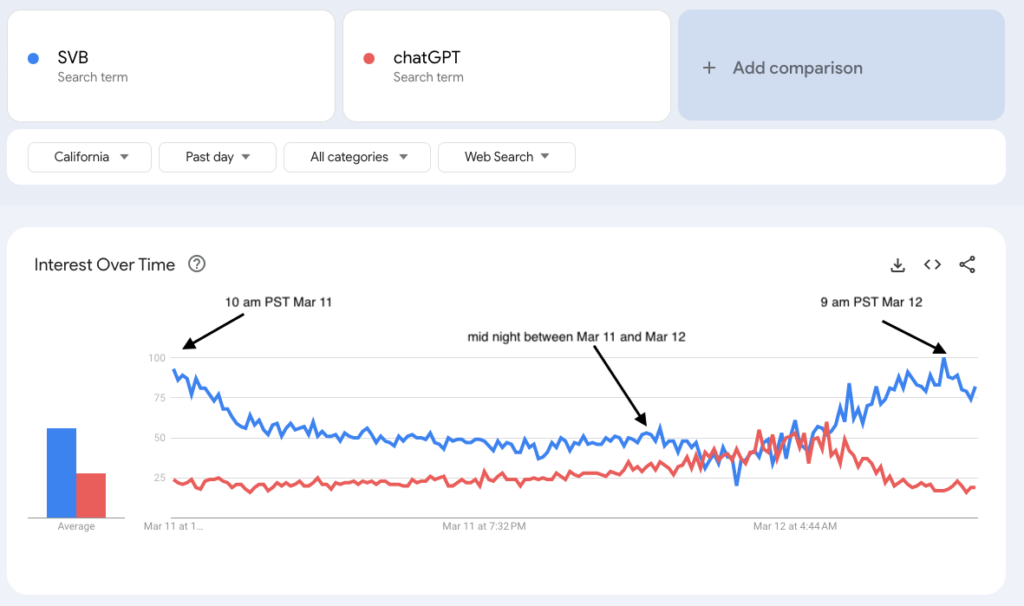

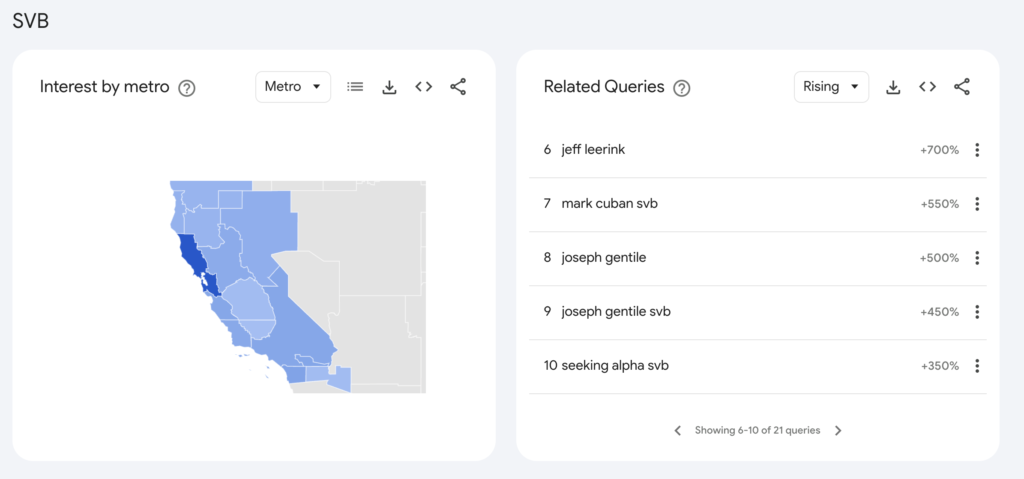

Next, I want to understand in California, where SVB is based, what people are looking for in this topic.

Interest (and worry) about SVB remained high well into the night between Mar 11 – Mar 12

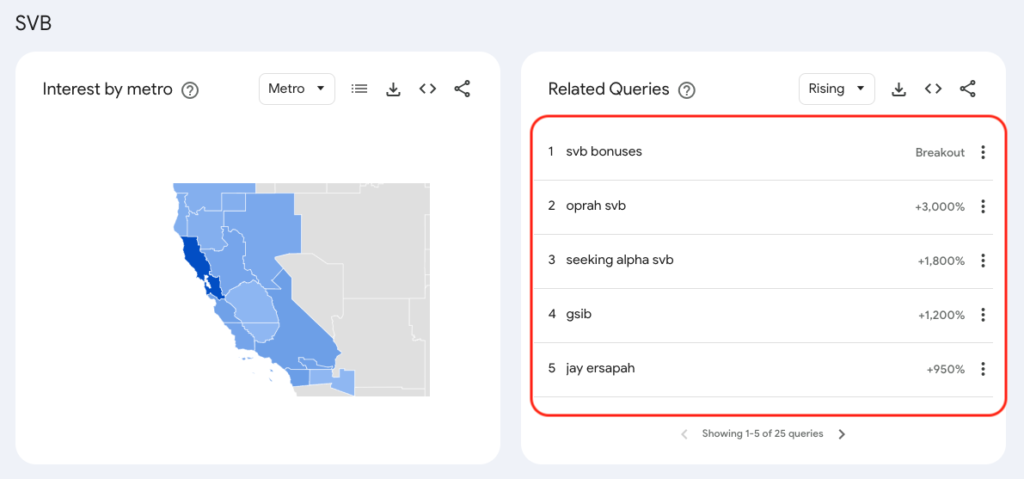

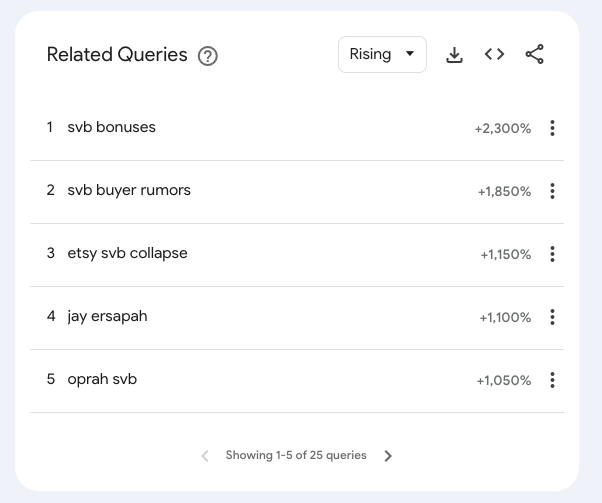

News about “SVB bonuses” is of the top interest in California over the past 24 hours

Wait, “SVB bonuses”??? What is that about?

Poor me. I didn’t follow the news closely enough. As it was reported by CNBC, Fox Business, Axios and many other outlets, “Silicon Valley Bank on Friday paid out annual bonuses to eligible U.S. employees, just hours before the bank was seized by the U.S. government.”

This is for the work done in 2022? I thought that SVB had done terribly for their shareholders, their customers over the past 1-2 years so why the bonus?

I don’t have any internal context but this looks bad, especially in this tough economic environment and the hundreds of billions of deposit money being stuck. What was on the mind of the SVB board? We need a lot more disclosure from the bank, their board to understand why and how they made certain important decisions.

Oprah and SVB?

Again this surprised me. Why are people in California searching for news about “Oprah SVB”? From what I can gather online, there seems to be rumours about Oprah keeping a lot of money at SVB bank.

I don’t have any special knowledge to know if this is true or not true.

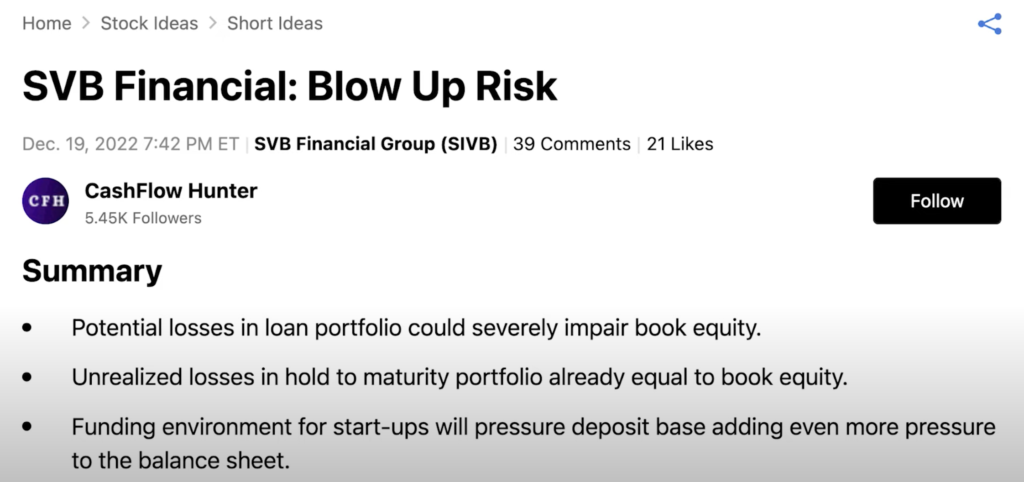

Seeking Alpha reported blow up risk at SVB back in Dec 2022

The third rising interest in the list is about a report that Seeking Alpha put out back in Dec 2022 where they shared the potential blow up at SVB. Here is the screenshot of the topline summary, taken from All In podcast. (Use the link to go to Seeking Alpha website to read the report if you want to.)

The topline summary from Seeking Alpha was spot on.

GSIB

Candidly, I didn’t know what “gsib” stood for before today. I heard the term systematically important bank before but didn’t know the specific term GSIB. (GSIB: global systematically important bank).

I did a bit more research and basically people have been talking/speculating about whether one of the top banks in the US is going to buy SVB, orchastrated by the Fed. As per usual, there are speculation / rumors for and against the idea.

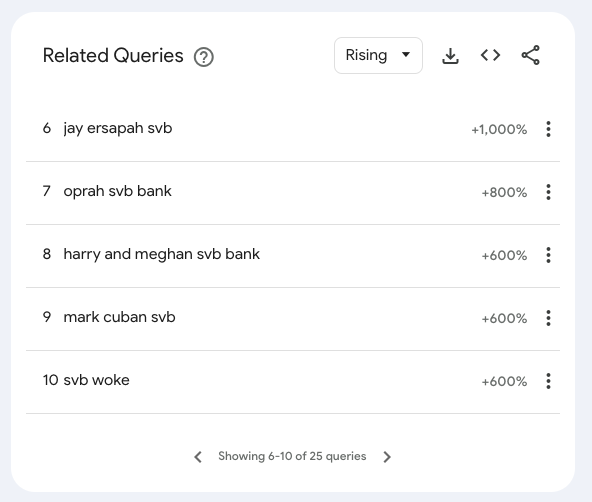

Jay Ersapah

She is the risk assessment chief at SVB so it is understandable that people want to know more about her, given this collapse. I won’t comment on what many news outlets reported about her over the pat 24 hours. You can google that on your own.

Jeff Leerink and Joseph Gentile

Continue with the list of top queries related to SVB over the past 24 hours, Californians are searching about “Jeff Leerink” and “Joseph Gentile”

Jeff Leerink is the CEO of SVB securities. There has been a few reports about “SVB Securities Management Exploring Buying Firm Back.”

Joseph Gentile is the chief Administrative Officer at SVB securities according to their website. There are articles about his past since from his bio “Prior to joining the firm in 2007, Mr. Gentile served as the CFO for Lehman Brothers’ Global Investment Bank where he directed the accounting and financial needs within the Fixed Income division.”

What people are searching for across the US about SVB collapse

Here are the top queries that people are searching for over the past 24 hours in the US.

We can see a lot of similarities with how Californians are following the news, with the exceptions of:

- Etsy delays payment to sellers due to SVB

- Harry and Meghan: there are rumors that they have millions of deposit money at SVB.

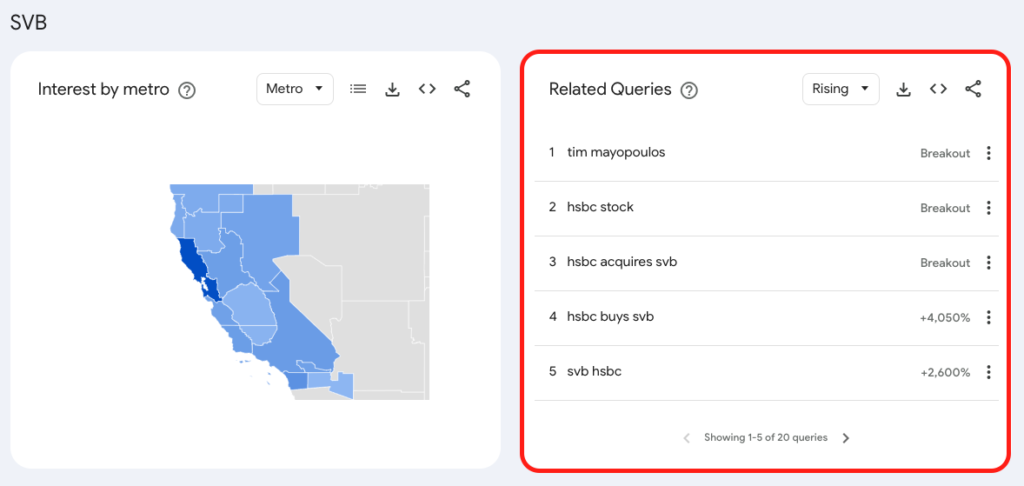

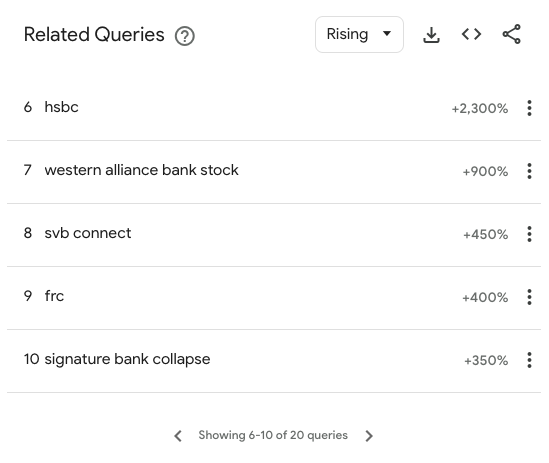

HSBC acquiring SVB, Western Bank Stock, Tim Mayopoulos, FRC, and Signature bank are the top rising queries from Mar 12 – Mar 13

As we continue to follow this event, here is the list of topics that are attracting the most interest from Californians from Mar 12 – Mar 13.

The first query is about “FDIC names former Fannie Mae chief as CEO of Silicon Valley Bank”. Many of the subsequent queries are about:

- The HSBC acquisition of SVB in the UK

- Western alliance bank stock price plunged from $49 (last Friday) to $8 (early morning Mar 13) then recovered to $26 by the end of the day. Over the past 5 days, the stock price dropped by more than 65%.

- Signature bank in NY collapsed over the last weekend.

- First Republic Bank is rumored to suffer heavily from a bank run.

That’s all from me for now. I will continue to follow this news to understand potential second or third-order impact on many of us. Feel free to leave your comments below.

Chandler

[jetpack_subscription_form]