Navigating the world of home buying can be daunting, especially for first-time buyers. Understanding how changes in interest rates affect mortgage payments is crucial to making informed decisions. This article provides a visual guide to illustrate this impact, and addresses a common query: is buying a home more financially sound than renting? Let’s delve into the complexities of the mortgage landscape, with a special focus on the rising interest rates scenario.

Demystifying Mortgage Calculations

Mortgage calculators are handy tools for understanding your potential financial commitment. Let’s walk through a simple example using a mortgage calculator from Bank Rate.

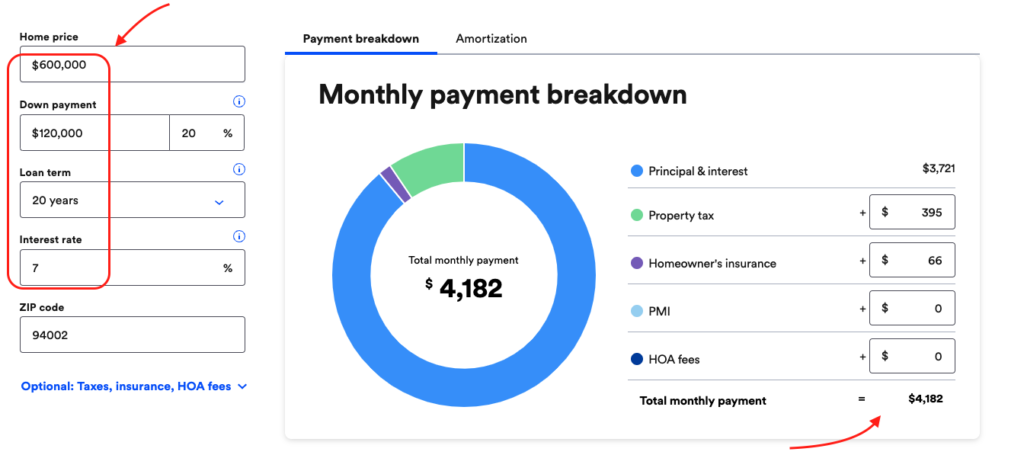

Let’s assume:

- Target home price: $600,000

- Down payment: 20% ($120,000)

- Loan term: 20 years

To get an accurate monthly payment, you’ll also need to input your zip code and homeowners association (HOA) fees, if applicable.

Some of you may stop here and just look at the monthly payment and mentally compare it with your current rent. Don’t do that. Check out the Amortization tab.

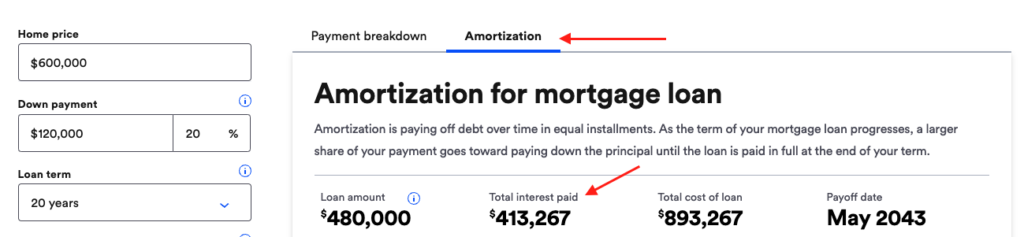

The Importance of Amortization in Mortgage Loans

Many people compare the calculated monthly payment with their current rent, but this isn’t enough. It’s vital to look at the loan’s amortization, which shows the total interest paid over the loan’s duration.

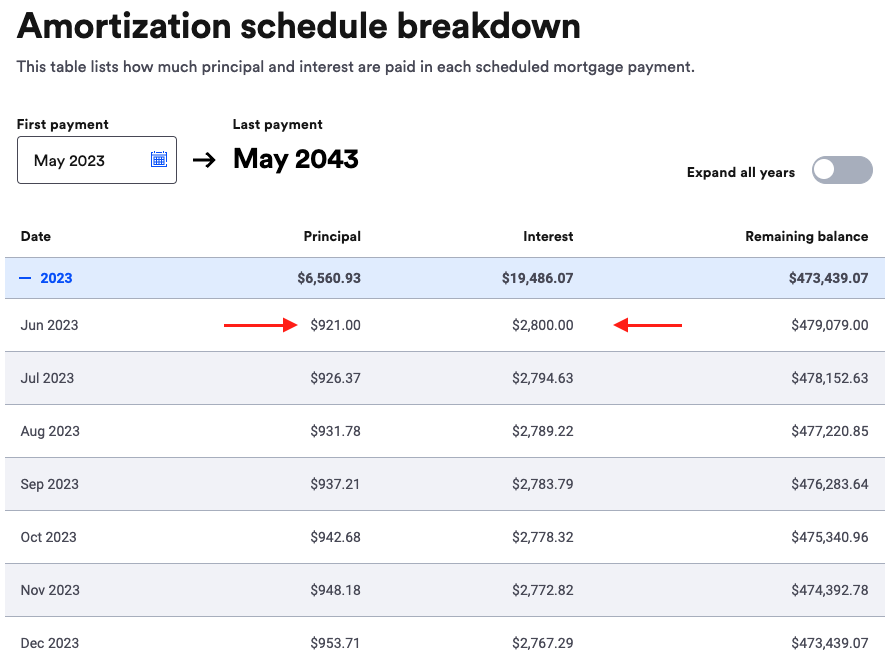

Take a $480,000 loan over 20 years at a 7% interest rate, for example. The total interest paid is around $413,000 – over 80% of the loan amount! This means that despite a monthly mortgage payment of about $4,100, only around $900 goes towards the principal, with the remaining $2,800 servicing the interest in your first few years.

The Role of Interest Rates in Mortgage Payments

Interest rates greatly influence the total interest paid. The chart below illustrates the total interest paid for the same loan at different interest rates, ranging from 3% to 7%. Just a few years ago, Americans could secure a 30-year mortgage at a fixed rate of about 3%. With rising interest rates, the total interest paid could double at 7%.

Another way to look at this is to see how the total interest paid compares with the principle loan amount.

There is no one size fit all

Why are we sharing this information? Our aim is to empower prospective home buyers with the knowledge to make informed decisions.

A few key takeaways:

- Don’t solely focus on the monthly payment when considering a mortgage. Look at the bigger picture.

- Small reductions in interest rates can result in significant savings over the life of a mortgage.

The Possibility of Refinancing

Yes, that is an option and a possibility that you can consider for the future. However, please note that according to the Federal reserve, they are not planning to lower interest rate in 2023 so it may be prudent not to count on refinancing at a cheaper rate in 2023.

Understanding Home Price Fluctuations

One of the best home price index is the Case-Shiller index.

Home prices tend to increase over the long term, but there can be short-term dips. The Case-Shiller Index, a leading home price index, shows that US home prices generally rise over the long term. However, from 2006 to 2012/2013, home prices decreased substantially across the US.

Also, it is better that you check the home price trend of your local area vs a national index.

Conclusion

Understanding the dynamics of mortgage payments, interest rates, and home prices is crucial when considering a home purchase. Use this information to your advantage when making your decision. If you found this article helpful or have any more questions on home buying, feel free to drop a comment below or subscribe to our newsletter for more advice.

Chandler

P.S: This article was written with the help of A.I

[jetpack_subscription_form]