Halo guys,

I am sure many of you may hear or read about the new Google Insights for Search tool before.

Many different blog posts have been discussing about how to use the new tool with some examples from US/Europe market.

Avinash just wrote a new post called “Competitive Intelligence Analysis: Google Trends for Websites“, in which he detailed how Google Trend can be used to gain competitive information.

More importantly it’s about what you can do with the information.

There are not that many blog posts about how applicable Google insights for Search is to Singapore or SouthEast Asia. So i will highlight some of my thoughts regarding this tool in local context here.

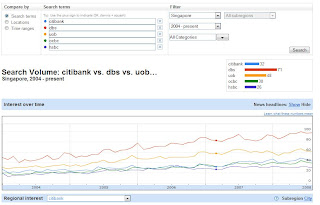

Firstly, let’s take a look at the comparison of 5 banks in Singapore: DBS, UOB, OCBC, Citibank and HSBC.

They are either the top local banks in general or very strong in retail/consumer banking.

The reason i choose them because if they only offer corporate banking, i don’t think there will be a lot of Online Interest

- As you can see from the picture, each bank is represented by one color.

- At the top right hand corner, you can apply different filters. In this case, i only want to show the results for Singapore markets only.

- As for the duration, you can only see the data back to 2004

- Now, for the main information itself, the search volume is a relative number. “The numbers on the graph reflect how many searches have been done for a particular term, relative to the total number of searches done on Google over time. They don’t represent absolute search volume numbers, because the data is normalized and presented on a scale from 0-100; each point on the graph is divided by the highest point, or 100″

In short you should focus on the trend and comparisons amongst brands rather than the absolute numbers itself.

- It’s quite obvious from the picture itself for brand/marketing managers of those brands whether they are popular or not so i am not going to comment too much about it.

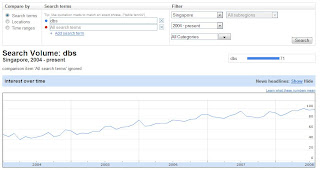

For example, if you zoom in DBS, you can see that the Online Interest of people in Singapore regarding the brand has increased 250% in the past 4 years.

That is really an amazing growth for such a market like Singapore.

However, you shouldn’t stop there because with that information alone, you can’t take any actions on it!

You should continue to do keyword research to understand whether people are search for DBS products online, credit cards, loans or trying to reach DBS to complain about their services, apply for jobs etc…

Another thing to note is to match those peaks over the years with major new product launches or positive/negative PR news etc…

If DBS hires a new agency to handle their online marketing, obviously they can use this tool to understand roughly whether the agency has been doing a good job

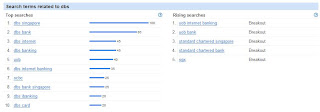

Google also provides Top Searches or Rising Searches under Search Terms section.

However, i think you can have a better idea by using Google Keyword tool instead. The reason is that you can see the actual search volume for a given month rather than just a relative number.

Ok that’s for Singapore.

How about in other SEA countries?

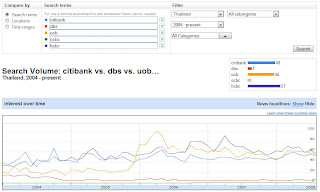

- For Thailand, the same 5 banks:

For bigger countries like Thailand, you can zoom in to subregions within a country like Chiang Mai, Chon Buri etc.. for Thailand

Unlike Singapore, Online interest for these brands in Thailand have fluctuated a lot in the past 4 years.

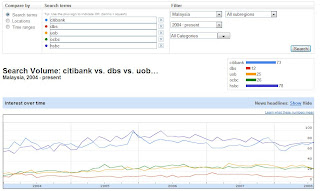

- In Malaysia

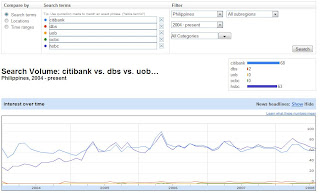

- In the Philippines:

It’s clear for the Philippines, i need to compare local banks as DBS, OCBC and UOB are almost non existent in those countries for retail/consumer banking

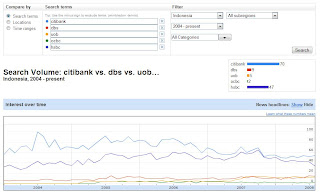

- In Indonesia:

It worries me to see such declined trends with regards HSBC and especially Citibank. Are they pulling out of Indonesia in terms of consumer banking?

- In Vietnam:

As expected, only HSBC has a real presence in Vietnam. However, looking at the growth rate in terms of Online Interest for them, i guess they are doing pretty well YoY

I take the liberty to compare HSBC with some other local/foreign banks in Vietnam

I must say HSBC is going pretty well compared to local banks, especially that they only entered the market not long ago. ANZ bank, one of the most senior foreign banks in term of time in the market, has been rather disappointing for their online presence.

Interestingly, we can zoom in further into subregions for Vietnam as well. So in SEA, only Singapore and Vietnam are the two countries that Google doesn’t provide sub region information. Singapore is because it’s too small. As for Vietnam, i think it’s because of lack of information and search volume.

In short, I think by now you roughly have an idea of how to use Google Insights for Search in local context, Singapore or SouthEast Asia. Just remember, Google Insights for Search only provides very top line information. You need to dig much deeper to come up with more concrete data and make an informed decision.

Good night,

Chandler