This post is for you if you are paying rent in the US. For the first time in the US, you can pay rent using a credit card without paying the transaction fee (2-3%) and still earn reward points. While Bilt doesn’t disclose exactly how much each point is worth (given the 1:1 transfer ratio to many airlines and hotels), you can earn about 1%+ back from rent using Bilt. The median monthly rent in the US is about $2000 (according to Redfin) in 2022; an average renter in the US can earn about $240/year using Bilt. I wrote about Bilt before and this post includes additional information about the card. If you think this is suitable for you, you can use this referral link to apply for the Bilt credit card.

Table of Contents

- Pros and Cons of the Bilt credit card

- Is it a card for you?

- Double points on the first of every month

- My personal experience of using Bilt credit card

- Protection benefits and Travel benefits

- Share this with a friend

- FAQ about Bilt credit card

- What do you need to qualify for a Bilt credit card?

- How hard is it to get the Bilt credit card?

- Is Bilt owned by Wells Fargo?

- Can you use Bilt to pay rent?

- How does Bilt send a check?

- Does Bilt do a hard pull?

- How do I pay for my Bilt card?

- What credit bureau does Bilt credit card use?

- Can I use my Bilt credit card anywhere?

- Can I pay my mortgage with Bilt credit card?

- How much is a Bilt point worth?

- What is better for my points: Bilt Travel portal or transfer partners?

- Is the Wells Fargo Bilt card metal?

- Does Bilt report rent payments?

Pros and Cons of the Bilt credit card

| Pros | Cons |

| 1. Zero fees for using Bilt credit card to pay rent 2. Wide range of rent payment options, including ACH (bank transfer) via online payment system, physical checks sent to your landlord, Venmo, Paypal 3. 1X points on rent payment (cap at 50,000 points per year) 4. $0 annual fee 5. Wide range of redemption partners: 100+ partners (including hotels like Hyatt, airlines, fitness, and even a downpayment on a home). 6. Each Bilt point is worth 1.25 cent when using the Bilt portal to book travel | 1. No sign-up bonus (SUB) 2. Cap at 50,000 points per year from rent, so if your rent is more than $4,200/month, too bad 3. 2X points on travel, which is lower than other travel-specific cards 4. 3X points on dining, which is good but below the best of the best. It is equivalent to Chase Sapphire Preferred, though. |

The above is a quick summary. I will start to dive into more details below. Alternatively, if the content is too long and you want to ask some questions, you can use the chatbot that I recently built here. (This is still an experiment so be aware of hallucinations).

Is it a card for you?

Rather than giving the standard, there is no “one size fits all” answer, I will try to provide some specific comments, examples, and recommendations:

- If your main purpose is accumulating credit card reward points for travel, then you probably know that Chase and American Express are among the most popular programs. With Chase, they have the unofficial 5/24 rule so consider that. The 5/24 rule means that you will not be approved for any additional Chase personal credit card if you have opened more than five personal credit cards over the past 24 months. This is not the unofficial rule, however, and there are exceptions.

- You may want to “max” out of your desired Chase credit cards first.

- I personally got approved for another credit card from Chase after getting five personal cards in less than two years, so I know there are exceptions. And Chase changes their tactics based on market conditions.

- Given that Bilt doesn’t offer a sign-up bonus (SUB), if you come across an attractive sign-up bonus (like 60,000 points from Chase or 80,000 points from American Express) and want to take advantage of those sign-up bonuses first, it’s fine.

- Remember that Bilt caps your earnings from rent at 50,000/per year so do the math to see if it makes more sense to apply for Bilt first (and earn points), and then a few months later apply for Chase or Amerian Express.

- If you are an expat, who just moved to the US for less than six months, should you get a Bilt card?

- Per my previous post, your main goal should be improving your credit score. Check out eight tips to improve your credit score as expat in the US.

- You may not have many options about opening the first credit card so go ahead as best as you can. I recommend City national bank if your situation allows it. Check out this post about “Tips on how to prepare for relocation from Asia to the US“, tip #3 and #4.

- Once your credit score is good to excellent and you consider between Chase and/or American Express/Capital One, then I think Bilt is a no-brainer for expat who rents. It is a good way to build your credit history too, because your rent payment is reported to the credit bureaus.

- If you worry that using credit card to pay may increase your credit utilization rate hence lowering your credit score, Bilt has the BiltProtect function, which helps you with that. Bilt does that by “pulling the full rent payment directly from a connected bank account (kind of like a debit card)“. So as long as you connect a bank account to your Bilt account and have enough money for rent, it should be fine.

Double points on the first of every month

Bilt has an ongoing promotion in which you can earn double the points on the first of every month. They call it the Rent day promotion.

This means 6X on dining, 4X on travel, and 2X on other purchases. Given that you need at least five qualifying transactions per month to earn Rent points, one way to do that is to have all of the five transactions on Rent day i.e., kill two birds with one stone.

For example, you can use the Bilt card exclusively on the 1st of every month.

The exact wording from Bilt about the five transaction criteria is “When you make at least five posted transactions in a statement period using your Bilt Mastercard, you’ll earn points on rent and qualifying net purchases (purchases minus returns/credits) for that statement period.”

My personal experience of using Bilt credit card

After I applied for the card, the approval was instant, and the physical card arrived after a few days. While you wait for the card, you can still set things up on the Bilt rewards website.

Bilt gave you the bank account details so you can add them to the landlord’s online payment website. The setup process was straightforward, and I use the Bilt Protect function to keep my credit card utilization ratio low. Make sure that you link your checking account to Bilt so that Bilt can deduct money from there to pay for your rent.

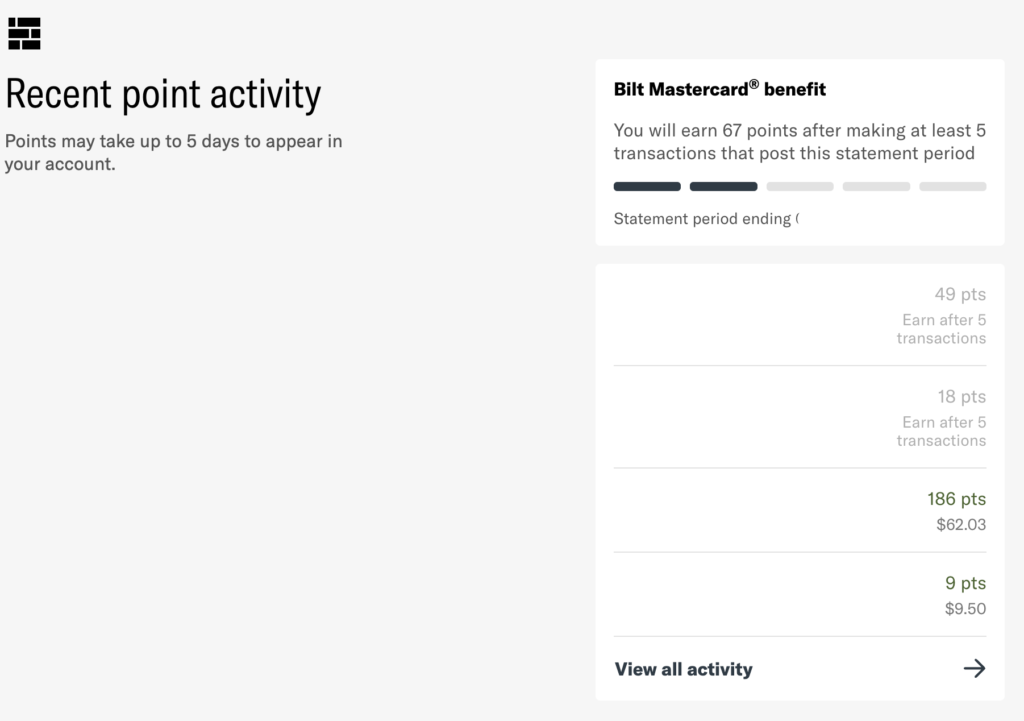

On the Bilt website, under my account, Bilt will show you how many more transactions you need to make during the billing cycle to meet the five transaction criteria from them. For example, this is what it shows to me during the recent statement period. I need to make additional three transactions.

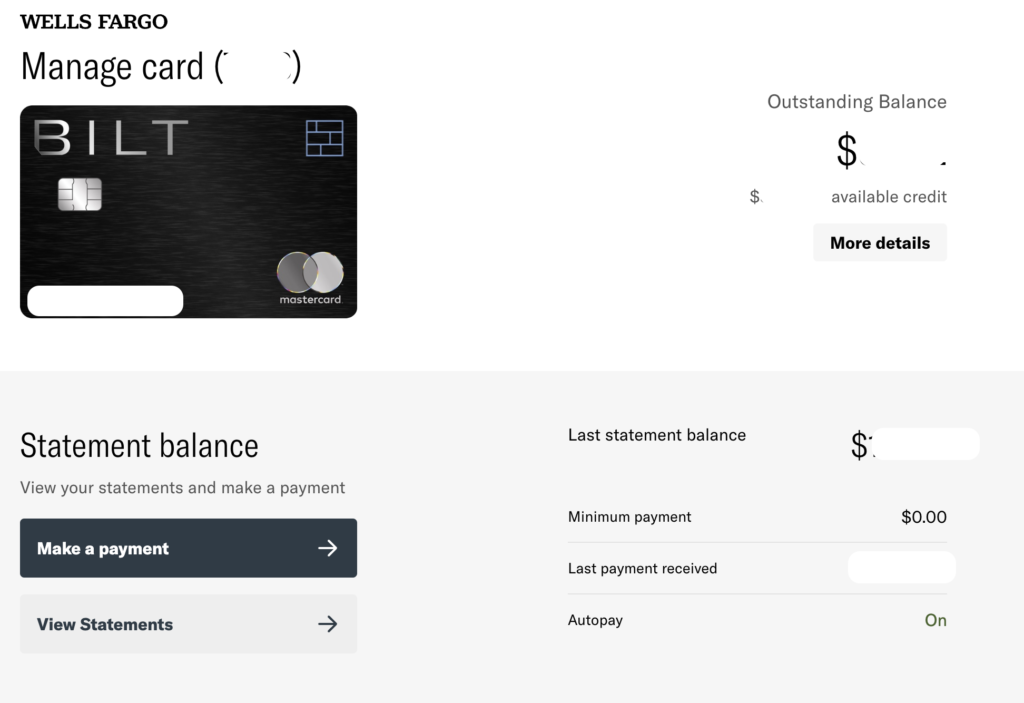

Using the Bilt rewards website, you can check the card balance, transaction details, manage your card payment, set up auto payment and do most things for your card.

Protection benefits and Travel benefits

The Bilt credit card is a MasterCard under the MasterCard World Elite program. So it also has many benefits provided by MasterCard.

The full guide to benefits is here on the Wells Fargo site as Wells Fargo issues the card. I list them below and encourage you to read through the fine print if you want to leverage these benefits. They are subject to change at any time, so giving you a direct source is better than summarizing them here.

Cellular Telephone Protection

This coverage reimburses You for the cost to repair or replace the Cell Phone in the event it is Damaged, Stolen, or is unrecoverable due to Involuntary and Accidental Parting. Cracked screens, cosmetic damage or scratches that do not impact the Cell Phone’s capabilities or functionality are not covered.

Mastercard ID Theft Protection

Mastercard ID Theft Protection alerts you to possible identity theft by monitoring the surface, dark and deep web, searching for compromised credentials and potentially damaging use of your registered personal information. It also provides you with resolution services should you find yourself a victim of identity theft.

Purchase security

If an item You purchase is damaged or stolen within the first ninety (90) days from the date of purchase, We may reimburse You the cost to repair or replace the item.

To be eligible for coverage, You must pay for the entire cost of the item with Your Covered Card and/or Bilt Rewards program associated with Your covered Account.

Auto Rental Collision Damage Waiver

This coverage reimburses You if a covered accident or theft occurs to the Rental Car.

To be eligible for coverage, the following must occur:

- You must pay for all of the cost to rent the car with Your Covered Card and/or Bilt Rewards program associated with Your Covered Card Account.

- You must decline the rental company’s collision loss/damage insurance.

Trip Cancellation and Interruption Protection

If a Trip is cancelled or interrupted for a covered reason (See What’s Covered), You may be reimbursed the cost of nonrefundable Common Carrier tickets.

The rest of the benefits are on the website provided above, so I will stop here.

Share this with a friend

If you enjoyed this article and found it valuable, I’d greatly appreciate it if you could share it with your friends or anyone else who might be interested in this topic. Simply send them the link to this post, or share it on your favorite social media platforms. Your support helps me reach more readers and continue providing valuable content.

FAQ about Bilt credit card

What do you need to qualify for a Bilt credit card?

Answer: from various online resources, it seems that your credit score needs to be higher than 670 to qualify

How hard is it to get the Bilt credit card?

Answer: It is not hard as long as your credit score is higher than 670, as mentioned above.

Is Bilt owned by Wells Fargo?

Answer: No. While Bilt World Elite Mastercard® is issued and administered by Wells Fargo Bank N.A; Bilt the company was founded recently in 2021 and is currently a private company. The Bilt rewards program is managed by Bilt, the company.

Can you use Bilt to pay rent?

Yes, you can. If you are a Bilt Alliance resident, you can pay rent directly using the mobile app or on the Bilt website.

If you live outside of the Bilt Alliance, you can still pay rent with the Bilt Rent account, which lets you pay landlords in existing portals by the automated clearing house or ACH. Bilt will give you a routing number and account number to pay rent, and you’ll still earn points. Alternatively, if your landlord requires a check, then Bilt can mail a check to your landlord on your behalf.

How does Bilt send a check?

Checks are sent via USPS® First-Class Mail® and take 5 to 7 business days to deliver. You can learn more about mailing a rent check with Bilt here.

Does Bilt do a hard pull?

Yes. Apply for a Bilt mastercard means there will be a hard pull from Wells Fargo/Bilt to evaluate your application.

How do I pay for my Bilt card?

There are multiple ways to pay your Bilt card balance. If you connect your bank account to Bilt, you can initiate the payment using the mobile app or website. Alternatively, you can pay using through Wells Fargo app or website, similar to other Wells Fargo credit cards.

What credit bureau does Bilt credit card use?

Since Wells Fargo issues Bilt credit cards, they use the same credit bureau that Wells Fargo is using to pull your credit history. As of Feb 2023, one strong possibility is Experian, which is subject to change. However, there is no harm in temporarily unfreezing your credit reports with all three credit bureaus when you apply for the card.

Bilt reports your rent payment to all three credit bureaus Experian, Equifax, and TransUnion.

Can I use my Bilt credit card anywhere?

Since the Bilt credit card is a Mastercard, you can use your Bilt credit card anywhere that Mastercard is accepted.

Can I pay my mortgage with Bilt credit card?

According to Bilt’s website, you can not earn points on mortgage payments yet.

How much is a Bilt point worth?

According to Richard Kerr, VP at Bilt, in this Q&A video, each Bilt point is worth 1.25 cents when you book travel or do other activities via the Bilt portal.

What is better for my points: Bilt Travel portal or transfer partners?

In the same video as above, Richard’s answer is very straightforward:

- Depending on the cash price for your plane ticket

- Each Bilt point is worth 1.25 cents so you can do your own calculation to understand how many Bilt points you need to book via the Bilt Travel portal

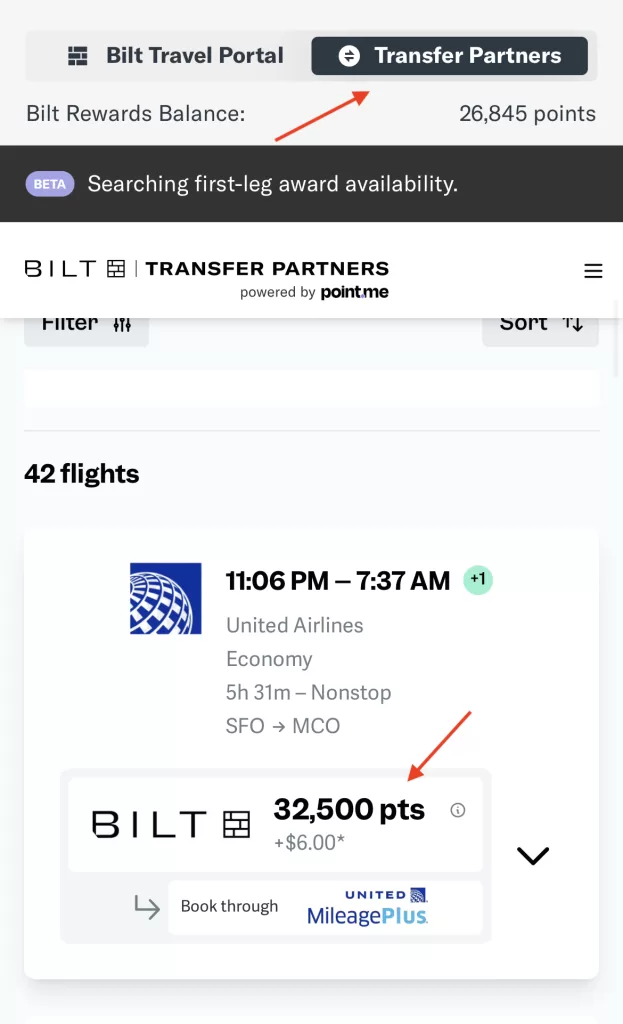

- Then compare that with how many miles you need if you book via the airlines. Remember the ratio between Bilt point and most transfer airline partners is 1:1

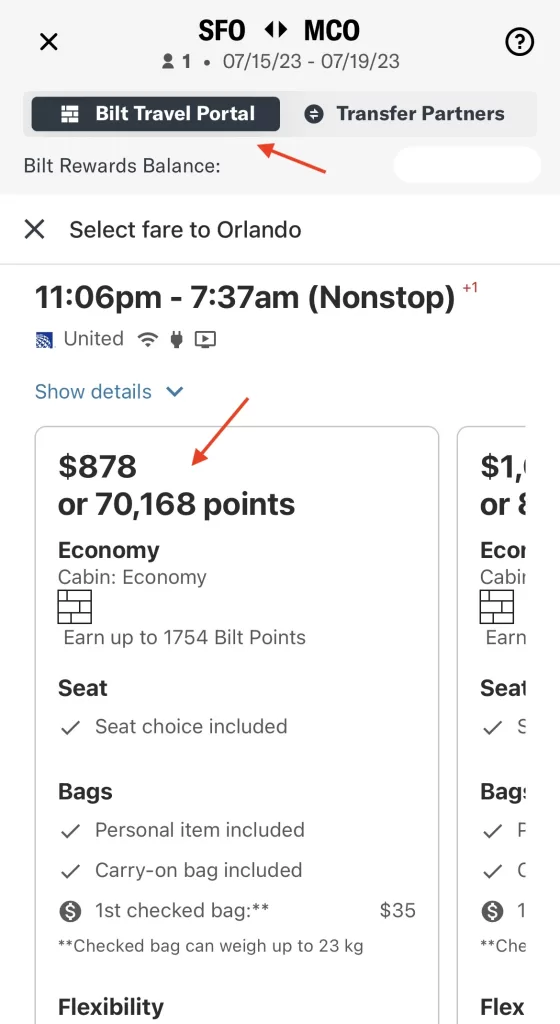

Let me use an example:

- Say you want to fly from San Francisco to Orlando (Florida) in Jul

- Searching on the Bilt portal for a non-stop flight costs $878 or 70,168 Bilt points for a United return flight, economy ticket.

- Searching directly on United Airlines, it says that for the exact same flight, it costs about 32.5k miles.

- So in this case, it is much better to transfer Bilt points to United Airlines and then book directly on United.

By the way, in the Bilt travel portal, there is a search function via “transfer partner” too. Basically, you can see directly on the portal the miles/points needed between booking directly on Bilt or via the partner. It is very convenient.

Is the Wells Fargo Bilt card metal?

Yes. The physical Bilt MasterCard is all black metal.

Does Bilt report rent payments?

Yes. Bilt can report your rent payments to all three major credit bureaus (Experian, Transunion, Equifax) for free. Specifically, this is on Bilt’s website “When renting at a Bilt Alliance property, you can choose to have your rent payments automatically reported by Bilt to the credit bureaus each month, which can help build your credit history with each on-time rent payment.”

There you have it. Let me know what you think below. If you think this is suitable for you, you can use this referral link to apply for the Bilt credit card.

Chandler

P.S: If you want to learn even more about the Bilt rewards program, check out the link.

[jetpack_subscription_form]