Hi there, this post is part of the series about South Korea that I have been writing in 2019. You can find other posts here:

8 key facts about South Korea Mobile Game industry

10 key facts about South Korea e-commerce

South Korea digital marketing landscape (updated 2019)

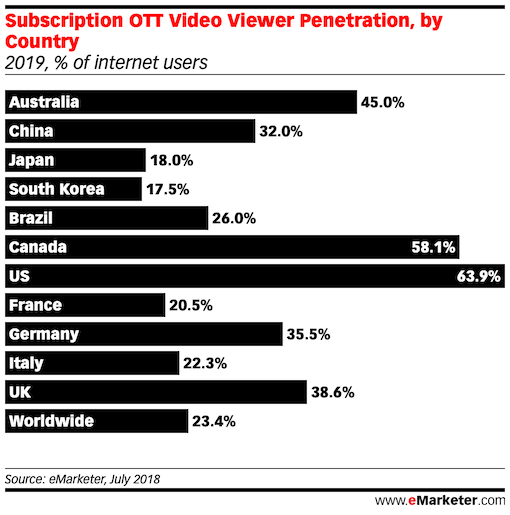

1. Subscription Video on Demand (SVOD) penetration in South Korea is at around 18% of internet user, lower than China, G7 economies or worldwide average

Growth rate for OTT service in the next few years is expected to be low

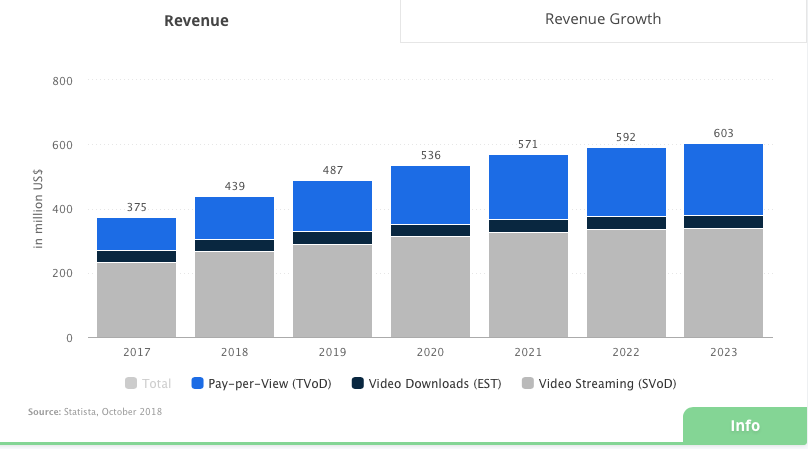

2. SVOD revenue in South Korea is estimated at nearly $500M in 2019

Data from Statista Oct 2018

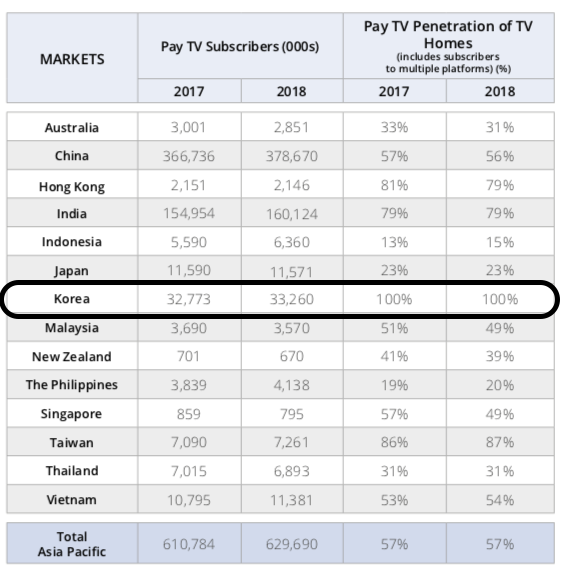

3. South Korea Subscription OTT growth has been challenging because of the 100% penetration of pay TV

Data according to the Asia video industry report 2019

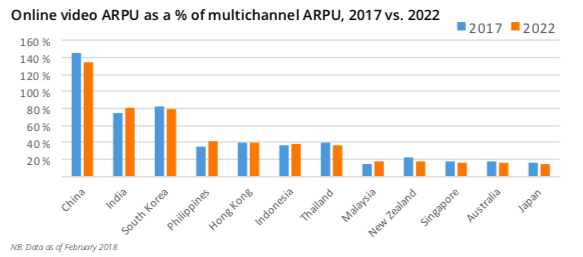

4. SVOD average revenue per user (ARPU) in South Korea is about 80% of an average multi channel TV service

What this means is that SVOD platforms need to differentiate itself clearly via content in order to drive growth.

5. SK Telecom joined forces with South Korean broadcasters KBS, SBS and MBC to create more local content for their OTT services

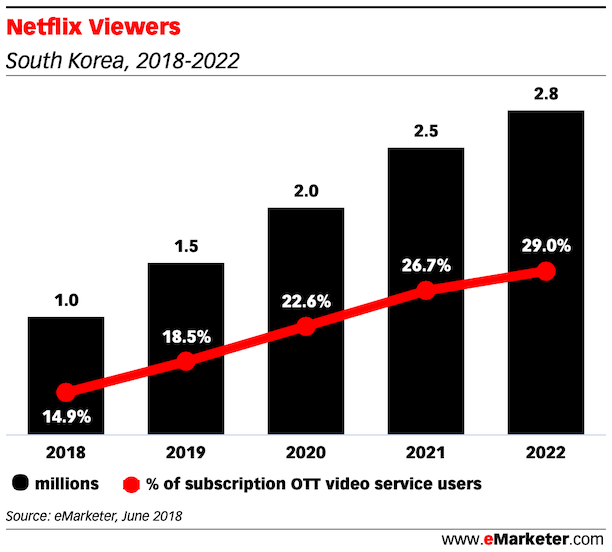

To fight fierce competition from Netflix, YouTube to local competitors (Watcha Play, Kakao TV, CJE&M’s TVing, LG’s LGU+, Olleh TV etc.), SK Telecom and 3 other broadcasters joined their respective platforms Oksusu and POOQ in 2019. And according to Media Partners Asia, the combined paid subscriber base is going to be close to 1 million. This is still lower than the estimated 1.9 million subscribers for Netflix in KR (by eMarketer).

6. South Korean consumers watch eSports equally via TV and digital platforms

According to eMarketer report “Sports OTT Landscape in South Korea“, unlike other countries, eSport is also available on many TV channels in South Korea like OGN (formerly Ongamenet, owned by CJ E&M), a cable TV channel that specializes in esports or AfreecaTV.

7. Amongst the younger demographics (19-49 years old), digital platform is becoming their preferred way of watching sports

If you have any additional insights that you want to add, feel free to email me or drop it in the comment section below.

Thanks,

Chandler

Dear Chandler,

great presentation on the South Korean VoD trends! I am right now writing my thesis about differences in the adoption behavior of VoD between South Korea and the US. For that, the graph about the netflix viewers in South Korea would be great to include. Unfortunately, I can’t find any quotable information, apart from that it is from eMarketer in June 2018. So I’d like to ask you if you could send me more information about the report, including which page, etc. that it has been published in.

I would appreciate your help a lot!

Best

Leonie

Hi Leonie,

Sorry I didn’t see your comment until now. As mentioned in my post, South Korea market is very different from the US. OTT penetration in South Korea is a lot lower than the US to I would expect the same for Netflix.

Dear Chandler,

Thank you for your insights. I wondered what you think of OTT platforms and the possibilities of Virtual Reality. VR as a medium has slowly started getting into the OTT space and has an opportunity to become a new way of viewer engagement and content distribution. Especially in South-Korea, with a highly developed OTT and VR market.

This month South Korea’s newest OTT service, ‘Wavve’, will be launched. Merged between Oksusu and Pooq and founded by KBS, MBC, and SBS and SK Telecom. Companies that invest heavily in VR and founded Wavve to ward off the surge of foreign video streaming giants such as Netflix in the local video streaming market.

What is your take on this? Do you have any useful sources that highlight both Virtual Reality and OTT in South Korea?

Kind regards

Jon

Hi Jon, thanks for your comment and question. While I don’t have specific data points about VR/AR development in South Korea, the fact is that South Korea is leading the world (with China) when it comes to 5G rollout. 5G will fuel the growth of VR/AR in OTT/or gaming massively accordingly a few reports from PWC. https://www.pwc.com/us/en/industries/tmt/library/global-entertainment-media-outlook.html or this one https://www.pwc.com/gx/en/entertainment-media/outlook-2019/entertainment-and-media-outlook-perspectives-2019-2023.pdf